Smarter Spending in 2026: Turning Gift Cards, Discounts, and Digital Tools into Real Savings

As the cost of living continues to rise, consumers are becoming far more intentional about how they spend, save, and move money. What used to be “nice-to-have” tools—discount platforms, gift cards, and digital payment solutions—are now essential parts of everyday financial decision-making.

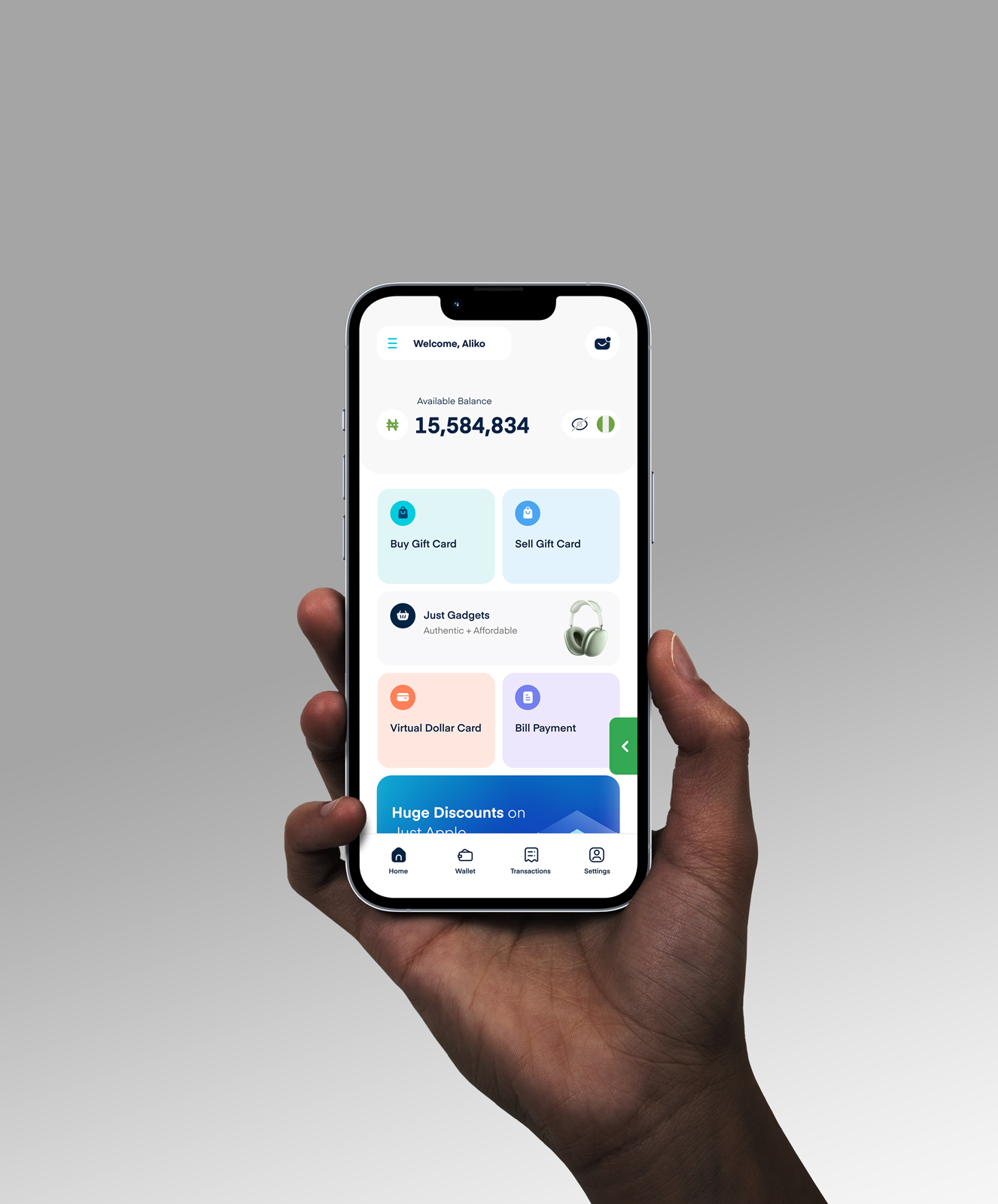

Platforms like Cardtonic are tapping into this shift by helping users turn unused gift cards into spendable value, access virtual cards for online payments, and simplify everyday transactions. But to really understand how consumers can stretch their money further, it helps to look at how different tools fit together.

Why Gift Cards Are No Longer “Dead Money”

Gift cards are often overlooked once they’re received. Many people forget about them, misplace them, or never find the right opportunity to use them. Over time, that value just sits idle.

According to Jimmy Zhao, shopping expert at Coupert, this is one of the most common money leaks among consumers.

“People underestimate how much value they’re leaving unused,” Zhao explains. “A gift card isn’t free money—it’s money you already own. If you’re not using it, you’re effectively losing purchasing power.”

This is where platforms like Cardtonic come in. By allowing users to convert gift cards into cash or usable balances, they remove friction and give people control over value that would otherwise go to waste.

Discounts, Cashback, and Value Stacking

Saving money today isn’t about one tactic—it’s about stacking multiple small advantages. Discount codes, cashback, and strategic use of gift cards can all work together.

Zhao notes that savvy shoppers are increasingly combining tools rather than relying on a single source of savings.

“Consumers who consistently save money online usually do three things: they compare prices, they use discounts or cashback tools, and they choose payment methods that give them flexibility,” he says. “When gift cards become part of that equation, the savings add up much faster.”

Using converted gift card balances for online purchases, subscriptions, or bills can significantly reduce out-of-pocket spending over time.

The Role of Digital Payments and Virtual Cards

As online shopping becomes more global, many consumers face limitations with traditional payment methods. Virtual cards—especially those denominated in major currencies—are becoming a practical solution.

Cardtonic’s virtual dollar cards allow users to pay for international services, subscriptions, and digital products without relying on conventional banking infrastructure. This is especially valuable for users who want flexibility without exposure to unnecessary fees or currency barriers.

Digital payment tools like this don’t just offer convenience—they give consumers more options to control when and how their money is spent.

Budgeting Beyond Discounts

Saving money isn’t only about paying less; it’s also about spending more intentionally. Sayer Willett, co-founder of Garmflow, sees this shift clearly in how people approach everyday purchases.

“People are moving away from impulse spending and toward more considered decisions,” Willett explains. “They want clarity—knowing what they’re spending, why they’re spending it, and whether it fits their lifestyle.”

This mindset aligns closely with platforms that simplify financial decisions. When users can consolidate gift cards, payments, and spending tools in one place, they reduce mental overhead and make better choices.

Bringing It All Together

The modern consumer toolkit isn’t about endlessly chasing deals—it’s about efficiency. Turning unused gift cards into active value, using discounts intelligently, and paying through flexible digital tools all contribute to a healthier financial routine.

Platforms like Cardtonic sit at the intersection of these trends, helping users unlock value that already belongs to them while making everyday spending easier and more transparent.

As Zhao puts it, “The future of saving isn’t about cutting joy—it’s about removing waste.”