Budgeting 101: How To Plan For Monthly Bill Payments

Growing up, budgeting and I were sworn enemies. My parents always taught me the importance of budgeting my allowance, but I never listened because I knew that once my money finished, I could always run back to mummy and ask for more. If that doesn’t work, sister Fadeke will come to my rescue. But as I have gotten older and started working, those handouts I used to enjoy from my family members have stopped. “What are you using your money for?” is the question I heard throughout last year. I had no choice but to take budgeting seriously and become good friends with him.

It’s been 15 months since I last billed my relatives. They no longer “accidentally” miss my calls, I have some savings, and most importantly, all my bills are paid.

In this article, I will show you how to plan for monthly bill payments so that you can stay on top of your finances.

Best 5 Ways To Plan For Monthly Bill Payments

The top five ways to plan for your bill payments are as follows: Identify your income sources—know what you earn to plan properly, list your monthly bills—write them down to avoid missing anything, allocate your funds accordingly—set aside a part of your income for your monthly bills, use an app to sort all your bills for efficiency, and review this budget regularly.

1. Identify Your Income Sources

The first step of budgeting is having a clear understanding of your income. You cannot spend what you don’t have (except in Delulu land). Sit down and calculate all that comes in monthly, including your salary, freelance work, investments, allowance, etc. If you have an irregular income, use your average income from the past six months for an accurate estimate.

2. List All Your Monthly Bills

Create a comprehensive list of all your monthly bills. This will help you visualize where your money is going and ensure that no bill is overlooked. This will include electricity, gas, mobile data, airtime, Wi-Fi, streaming services, etc.

3. Allocate Funds Efficiently

With a clear understanding of your income and monthly bills, you have enough information to allocate your funds accordingly. Try as much as possible to save some of your income before budgeting your monthly bills because bills choke. There might be some bills you must completely cut off based on your current earnings.

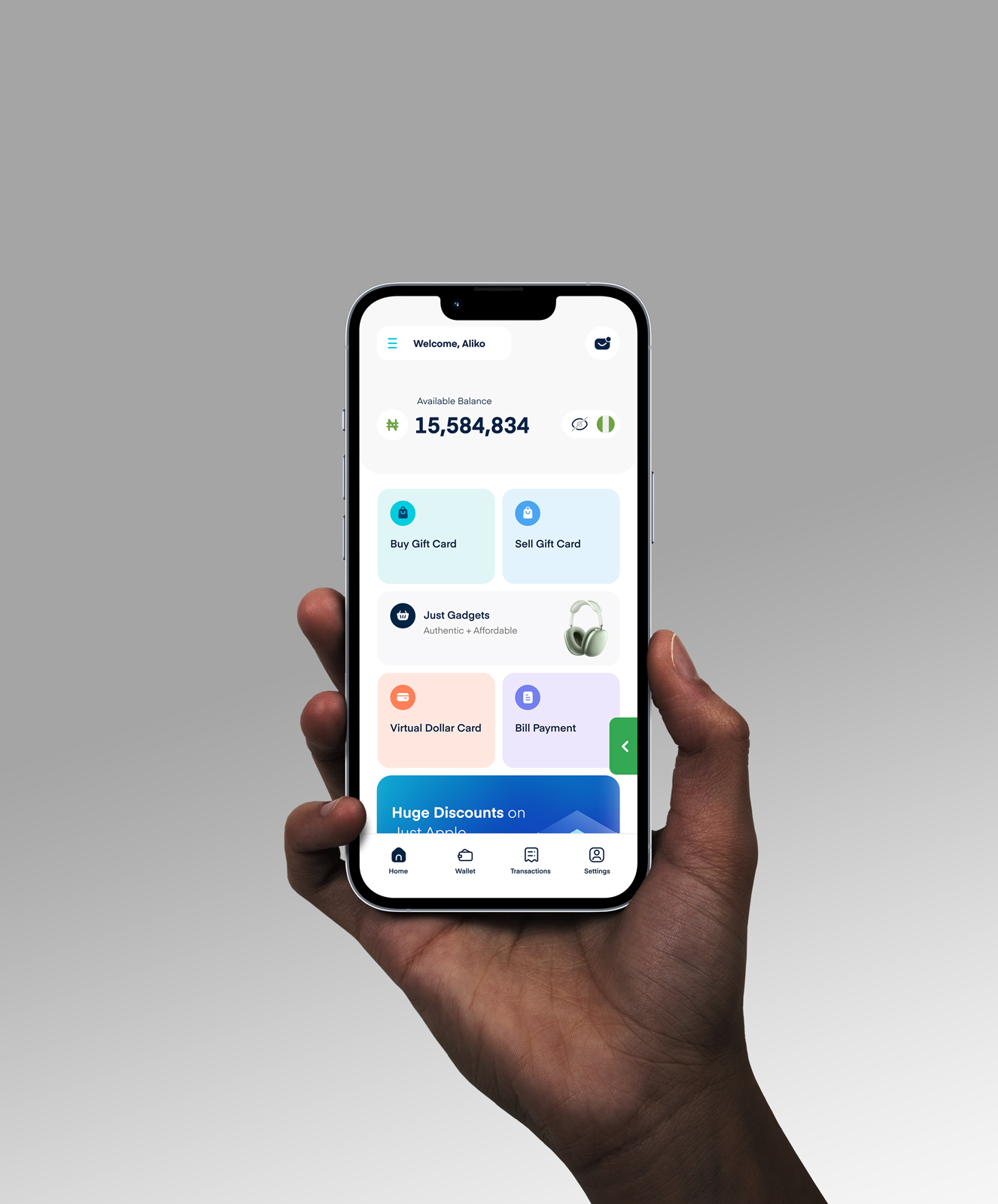

4. Use One App To Sort Your Bills

Using a bill payment app like Cardtonic to pay all your bills is convenient and effective. Cardtonic gives you insight into your spending habits, which can help you better manage your expenses for the coming months.

One month, I realized I had spent close to 200k on electricity alone, thanks to my Cardtonic app. Nobody needed to tell me to start turning off the AC before I went to bed, and I also think twice before microwaving food.

5. Review And Adjust Regularly

Your financial situation and expenses can change. Review your income and bills regularly, especially if you experience a significant life change like a new job, getting married, moving into a new apartment, etc. Adjust your budget to reflect these changes.

How To Pay Your Bills on Cardtonic

Sorting out all your bills with Cardtonic will be one of the best financial decisions you will ever make. You can pay your bills on cardtonic by following these few steps: Download the Cardtonic app, register on Cardtonic, open the application on your mobile device, fund your Cardtonic wallet, click on bill payment, select the bill category, choose the biller, enter billing details, and confirm the transaction.

- Download the Cardtonic app.

- Register on Cardtonic.

- Open the Cardtonic application on your mobile device.

- Fund your Cardtonic wallet.

- Click on bill payment

- Select the bill category. E.g., Mobile data.

- Choose the biller. For example, 9mobile.

- Enter your billing details.

- Confirm the transaction and proceed with payment.

Frequently Asked Questions About Planning Monthly Bills

1. How Do I Organize My Monthly Bills?

To organize your bills properly, you need to identify your income sources, list your monthly bills, allocate your funds accordingly, Use an app to sort all your bills and review this budget regularly.

2. What is The Best Strategy To Pay Bills Every Month?

Using an app like Cardtonic to pay all your bills is the best strategy for handling your monthly bills. Aside from the convenience Cardtonic provides, you can also track your bills spending to help you plan better for the coming months.

3. How Can I Pay Bills On Cardtonic?

Paying your bills on Cardtonic is easy. All you need to do is download the Cardtonic app, register on Cardtonic, open the application on your mobile device, fund your Cardtonic wallet, click on bill payment, select the bill category, choose the biller, enter billing details, and confirm the transaction.

4. What Type of Bills Can I Pay on Cardtonic?

You can pay your electricity, internet, cable TV, airtime, data, and many other bills on Cardtonic.

Conclusion

Effectively planning for monthly bill payments is an essential component of successful budgeting. By understanding your income, listing and prioritizing your bills, allocating funds efficiently, using an app to sort all your bills, and regularly tracking and adjusting your budget, you can maintain financial stability and peace of mind. Budgeting may seem daunting at first, especially if you are not good with money, but with consistent effort and adjustment, you are all set to be on top of your finances.