5 Tips For Avoiding Declined Transaction Fees On Virtual Dollar Cards

The experience of getting charged for declined transactions is often not very nice and can leave a bad taste in anyone’s mouth. When I first tried out a virtual dollar card, I tried to make a payment multiple times without checking my balance, only to be hit with a declined transaction fee charge, and subsequently, my card was frozen.

Some virtual dollar card providers can flag, freeze, or even charge for insufficient funds when you try your card more than once for the same transactions. Insufficient funds are the main reason for declined transaction fees on virtual dollar card payments. If your card gets declined multiple times, you will most likely get charged or even have your card frozen.

This article will help you with actionable tips to avoid declined transaction fees. In the end, you can prevent these situations and preserve your funds.

Why Do Card Providers Charge Declined Transaction Fees?

You may think virtual card providers are getting rich off the charges they collect from declined transactions. Well, that is not the case. The truth is that virtual card providers are often charged fees for every declined transaction by third-party processors like Mastercard and Visa. Since these costs often run into millions and are too much to bear, virtual card providers may transfer them to customers.

Additionally, these fees help discourage bad actors from abusing their system and help them check fraud. So, if you’re getting charged for a random transaction, you must ensure that you have enough balance before completing a payment.

How To Avoid Declined Transaction Fees On Virtual Dollar Cards

To avoid virtual declined transaction fees, check your balance regularly, keep track of subscriptions and keep a minimum balance on your account. Learn the card provider’s terms and conditions, and do not share your card with anyone.

Now you know them, let’s get into it.

1. Check Your Balance Regularly

Sometimes, users dive straight into payments without confirming their balance and forget to check charges incurred after a transaction. You must keep an eye on your balance.

After every transaction, checking what is left of your account is good practice; this will ensure you’re always aware when your balance drops so you can top up.

2. Keep Track Of Subscriptions

Be sure to track all subscriptions for renewal dates, including free trials; this will help you avoid declined transaction fees due to insufficient balances.

Remove your card or cancel all free trials and subscriptions you are no longer interested in before they are due.

3. Keep A Minimum Balance On Your Account

It’s in your best interest to maintain a minimum balance of at least $5 on your virtual card to cover charges and exigencies and spare your transactions from declining.

Remember that some cards incur maintenance charges, so leaving a minimum balance ensures these not-so-expected charges are covered.

4. Learn The Card Provider’s Terms And Conditions

It is essential to learn the rules governing the product you subscribed to, especially when onboarding. Card providers often provide information on charges relating to the use of their product on their website.

Furthermore, users should always stay abreast of updates and changes via the provider’s social channels and websites.

5. Do Not Share Your Card With Anyone

Sharing your card with others constitutes security risks and may lead to abuse. Inexperienced users can use the card inappropriately or even unknowingly subscribe to services, leading to declined transaction fee problems.

If, by any chance, your card is compromised, you can freeze it and ask customer service for assistance.

Frequently Asked Questions About Declined Transaction Fees On Virtual Dollar Cards

1. Why Are Virtual Dollar Card Transactions Declined?

Popular reasons for declined transactions include insufficient funds, transaction limits, international /geographic payment restrictions, card validity and authorisation issues.

2. What Happens If My Transaction Is Declined Multiple Times?

It all depends; some providers will automatically charge your account, disable/freeze your virtual dollar card, or even both. The objective is to serve as a deterrent and prevent fraud.

3. What Should I Do If My Virtual Dollar Card Is Declined?

If your virtual card is declined, try to find out why before attempting again. Typically, you should receive an error message. Then, you can top up your account in the case of a decline due to insufficient funds.

If the issue persists even after topping up, contact the platform’s customer service.

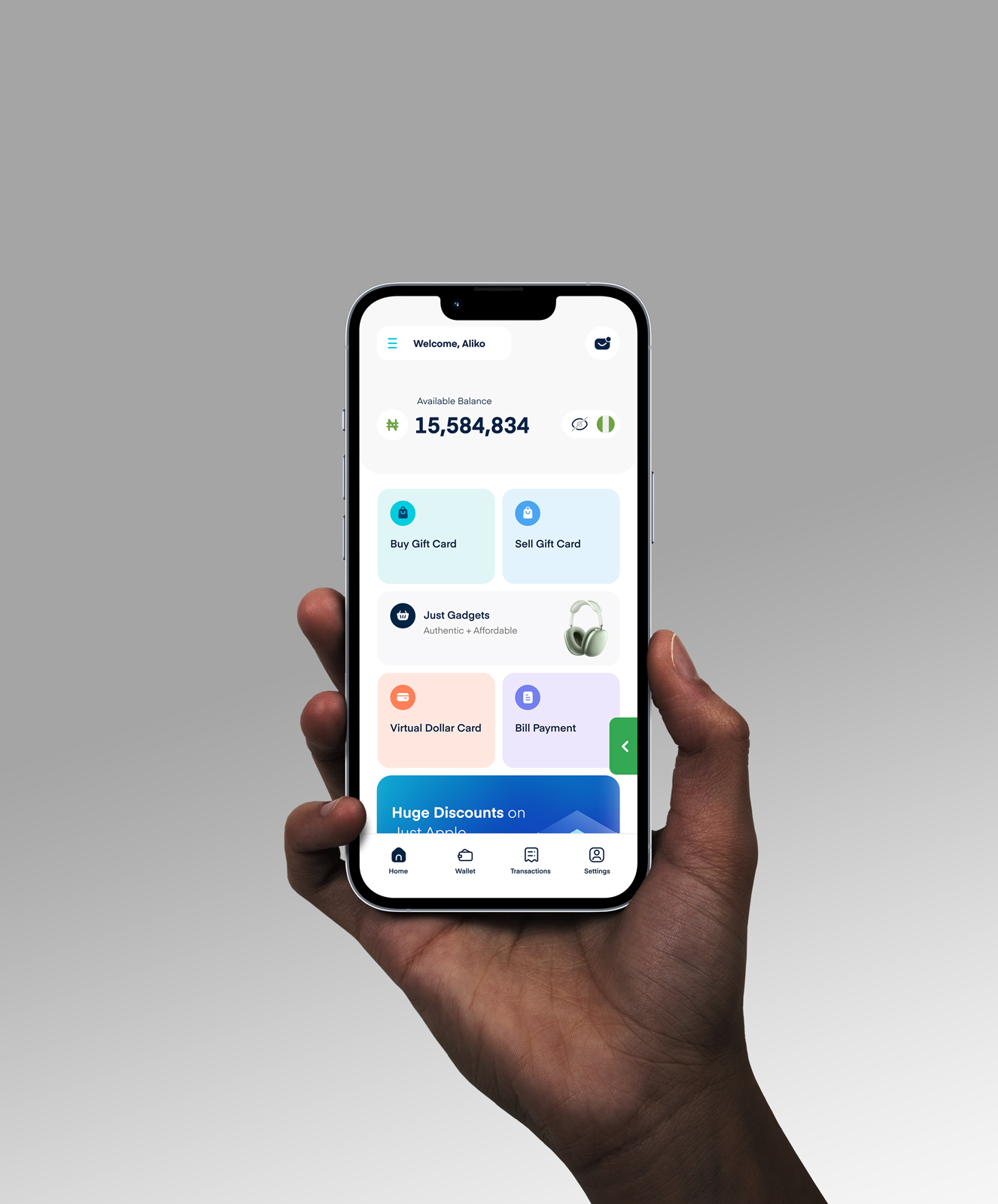

4. Does Cardtonic Charge Decline Transaction Fees On Its Virtual Dollar Card?

Cardtonic charges $0.3 for any failed, cancelled, or incomplete transaction on virtual dollar cards. Payment failure due to insufficient funds and payment timing out are typical scenarios that can trigger these charges.

5. Can I Challenge A Declined Transaction Fee?

Declined transaction fees are usually charged automatically. If you think you were charged wrongly due to a transaction decline, you can contact your payment provider to make a complaint.

Conclusion

Most people do not fancy them, but third-party processors charge declined transaction fees at the source. Virtual dollar card providers also use them to check fraud and discourage users from abusing their payment system.

While anyone can be charged a declined transaction fee without intentionally breaking the rules, it is expedient to avoid behaviours that could lead to them.

You can avoid declined transaction fees by tracking your balance and subscriptions and maintaining a minimum balance. In this article, I discussed tips for avoiding declined transaction fees on virtual dollar cards, saving you some annoyance and money in the long run.