How To Get A Virtual Dollar Card In Nigeria In 2026

Have you ever wanted to buy something online but couldn’t because it was priced in dollars? If you’re a Nigerian like me, you definitely know how frustrating that can be. Your regular Naira debit card just won’t cut it for those international purchases, am I right?

But don’t worry, I’ve got the perfect solution for you: virtual dollar cards. These cards allow you to make online payments in US dollars, even if you don’t have a domiciliary account or access to foreign currency.

In this guide, I’ll break it all the way down for you – what virtual dollar cards actually are, how they work, and most importantly, how you can get your hands on a USD virtual card as a Nigerian. So buckle up and get ready to have your mind blown!

What Is A Virtual Dollar Card

A virtual card is a digital card that can be denominated in different currencies, depending on the provider and the user’s preference. A virtual dollar card is a specific type of virtual card that is denominated in US dollars.

Unlike those traditional plastic cards, a virtual dollar card card exists only digitally. With a 16-digit card number, expiry date, and CVV code – just like a normal debit or credit card.

But the real beauty of virtual dollar cards lies in their convenience – with one of these USD virtual cards in your possession, you can bypass all the usual hassles of securing foreign currency or opening a domiciliary account. Instead, you can simply fund your virtual USD card with Naira from any Nigerian bank account, and use it to make payments on any international website or app that accepts US dollars.

With a virtual dollar card in your arsenal, you can shop, stream, subscribe, and splurge on all the amazing digital products and services the world has to offer, without any of the traditional limitations.

How Does A Virtual Dollar Card Work In Nigeria

Okay, so now that you know what a virtual dollar card is, let’s dive into how these cards actually work here in Nigeria.

Imagine you’re browsing an online store, and you’ve found the perfect product. But it’s priced in dollars! With a regular Nigerian debit card, you’d be stuck at this point. But with a virtual USD card, the game changes completely.

Here’s how it works:

1. You sign up with a virtual dollar card provider like Cardtonic and create an account.

2. You fund your virtual card with Nigerian naira from any local bank account. The naira gets instantly converted to US dollars at the current exchange rate.

3. You receive a unique 16-digit card number, expiry date, and CVV code – just like a physical dollar card.

4. When you’re ready to make a purchase, you enter your virtual card details as the payment method, and boom! The transaction goes through seamlessly. It’s that simple!

And the best part? Most virtual dollar card providers charge minimal fees compared to the high charges you’d face with traditional banking channels. It’s a win-win situation for savvy Nigerian shoppers!

Why You Need A Virtual Dollar Card In Nigeria

As a Nigerian in the digital age, having a virtual dollar card is an absolute necessity to participate in the global marketplace fully. From accessing international shopping to making hassle-free payments abroad, a virtual dollar card opens up a world of possibilities. Let’s explore the key benefits that make virtual dollar cards an essential tool.

1. Explore the global online market: Finally, with a virtual dollar card, you can shop at all those fantastic international websites and apps that accept US dollars. No more missing out on deals or being confined by Nigeria’s limited e-commerce options.

2. Hassle-free subscriptions and streaming: Want to sign up for that new streaming service or cloud storage option? Not a problem! A virtual dollar card makes it easy to pay for premium online services without having to open a domiciliary account.

3. Make global payments easily: Paying for international flights and hotel bookings, remunerating freelancers or contractors overseas: a virtual dollar card makes this possible. No more depending on dubious third-party companies or seeking help from close family members.

4. Avoid hidden fees and markups: Accessing foreign currency using conventional methods often involves hidden charges, mark-ups as well as fluctuating exchange rates. Virtual dollar cards offer a transparent, cost-effective alternative with fixed conversion fees.

How To Get A Virtual Dollar Card With Cardtonic

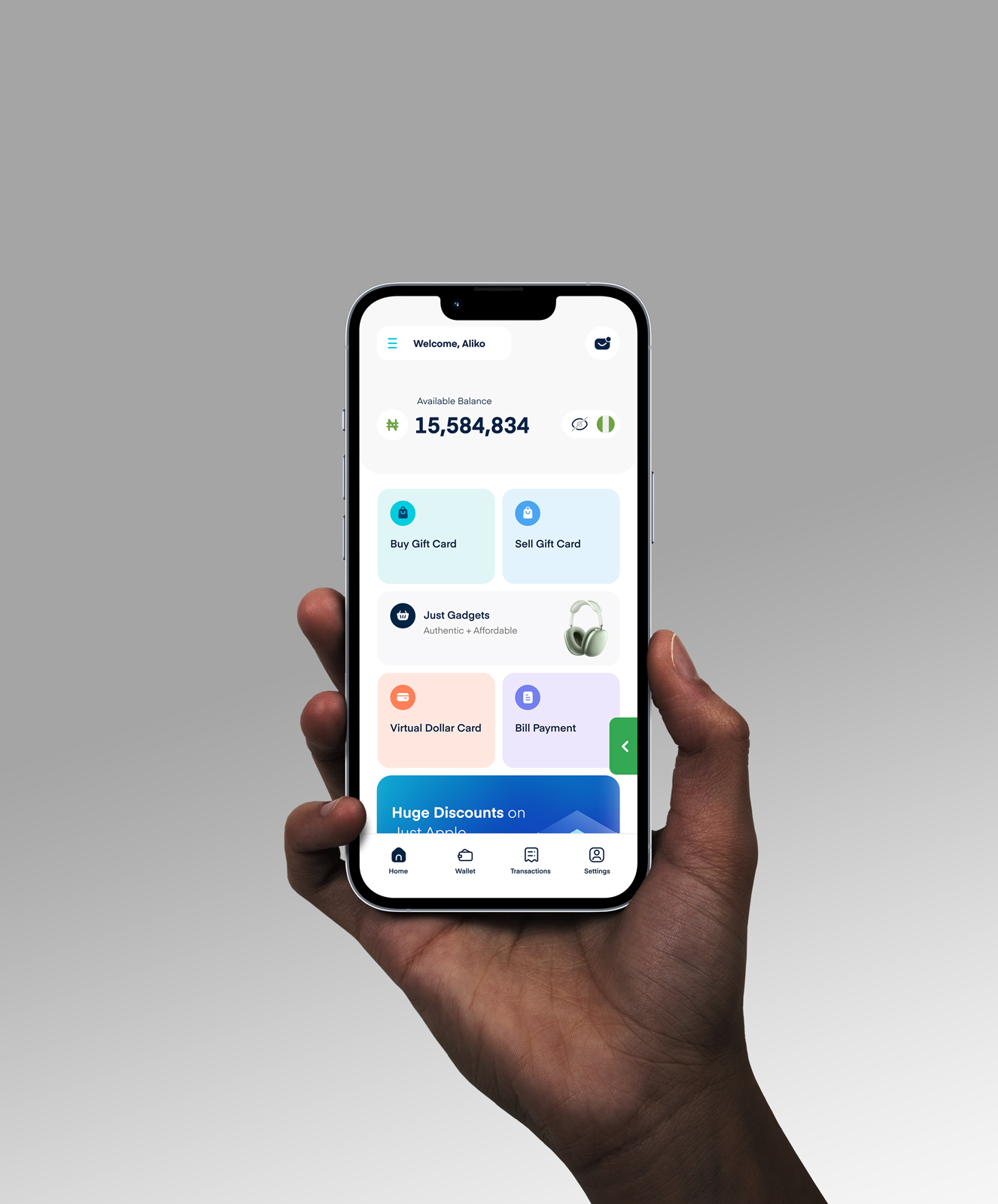

Cardtonic makes it incredibly easy to create a virtual dollar card in less than 2 minutes. Simply open the Cardtonic app, select the “Virtual Dollar Card” option on the dashboard, choose the preferred card type, input your details, and click on “Create Virtual Dollar” to complete the process.

1. Open the Cardtonic app and sign in to your account.

2. Click on the “Virtual Dollar Card” option.

3. On the launch screen, click “Continue” to proceed.

4. Select the type of card you want – you can choose between a VISA or Mastercard virtual dollar card.

5. Input your contact details, as this information is needed to create your virtual dollar card.

6. Click on “Create Virtual Card” to complete the process.

That is all. Once your virtual dollar card is processed, you can go back to the Cardtonic dashboard and see the details of your new shiny card, including the 16-digit card number, expiry date, and CVV code.

To understand more about how to create a virtual USD card on Cardtonic, please watch the video below:

Frequently Asked Questions About Virtual Dollar Cards

1. Can A Virtual Dollar Card Be Used In Nigeria?

Yes, virtual dollar cards like those from Cardtonic operate without issues in Nigeria. You can effortlessly use Cardtonic’s virtual dollar cards for online payments in US dollars on any website or app that accepts VISA or Mastercard, regardless of where you are.

2. Do I Need A Domiciliary Account To Get A Virtual Dollar Card On Cardtonic?

No domiciliary account is required when acquiring a virtual dollar card from Cardtonic. Actually, one of the main advantages of using a virtual USD card is that it eliminates the need for having a domiciliary account. You can simply fund your Cardtonic wallet with Nigerian naira from any local bank account, and Cardtonic will handle the currency conversion for you.

3. How Can I Get A Free Virtual Dollar Card In Nigeria?

Regrettably, there is no means of getting a completely free virtual dollar card in Nigeria because all providers of USD virtual cards charge for some services they render. Which include currency conversion charges. However, platforms like Cardtonic offer rates that are fair compared to its competitors and transparent pricing making it affordable for many Nigerians.

4. Which App Can I Use To Get A Virtual Dollar Card In Nigeria?

The Cardtonic app is an excellent choice for getting a virtual dollar card in Nigeria. You can download the Cardtonic app from the Google Play Store or Apple App Store, sign up for an account, and create a virtual dollar card in just a few simple steps. Cardtonic’s user-friendly app makes the process of obtaining and using a virtual dollar card incredibly convenient.

5. What Is The Best Virtual Dollar Card For Aliexpress?

Cardtonic’s virtual dollar cards are an excellent choice for making purchases on Aliexpress. Cardtonic VISA and Mastercard virtual dollar cards are widely accepted on Aliexpress and offer a hassle-free way to shop on the platform without the need for a domiciliary account.

Conclusion

Online shopping for Nigerians has never been the same again since the inception of virtual dollar cards; they offer an easy way to access US dollars for international payments. You don’t have to miss out on deals, be restricted from shopping or suffer from currency complications anymore once you get a Cardtonic virtual card. It’s a whole new world of endless possibilities – you can buy, subscribe or pay globally without stress.

What is even better is that it is quite simple to get yourself one of those virtual USD cards using Cardtonic’s friendly platform. With only a few clicks, you can create your own Virtual card and start making dollar payments funded by your Nigerian naira.

Don’t wait any longer. Become a part of these wise Nigerians who are already enjoying this convenient solution. Register with Cardtonic today and see how stress-free global digital payments can be. Believe me, once you go virtual, you’ll never return to the old ways!