Top 21 Virtual Dollar Card Providers in Nigeria in 2026

Making money is hard enough—why should spending it be a hassle, too?

It’s no longer news that Naira cards are restricted for international transactions. This limitation locks you out of essential platforms like Amazon, Apple Music, Netflix, and even crucial tools like cloud storage and freelancing platforms such as Upwork. Frustrating, right?

At first, getting a physical dollar card might seem like the solution, but the stress of opening a domiciliary account and hunting for forex is a nightmare no one wants to deal with.

Thankfully, virtual dollar card providers in Nigeria offer a smarter alternative. With just a few taps, you can create a card on your favourite payment app, convert Naira to dollars, and start making payments almost instantly.

Wondering which virtual card provider is right for you? Let’s find out!

21 Most Popular Virtual USD Card Providers In Nigeria

Here’s a quick look at 21 of the best virtual card providers with key details on fees and funding options to help you make an informed choice.

s/n | Provider | Card Creation Fee | Monthly Fee | Funding Options |

1 | Cardtonic | $1.5 | None | Naira, Cedis |

2 | Vesti | $10 | None | Naira ($10 min) |

3 | GeePay | $3 | None | Naira ($2 min) |

4 | Grey | $4 ($1 credited) | None | Naira, USD, GBP |

5 | Chipper Cash | $3 | $1 | Naira |

6 | Cardify | $2 | None | Naira, BinancePay |

7 | PSTNET | $7-$10 | None | Crypto |

8 | Zole | $2 | None | Naira |

9 | Klasha | $2 | None | Wallet funding |

10 | Bitsika | $3 | None | Naira, crypto |

11 | Dantown | $2 | None | Naira, crypto |

12 | Changera | Varies | None | Naira, Euro, Pounds |

13 | ALAT by Wema | Free | None | Naira |

14 | Spectrocard | $3 | None | Naira, crypto |

15 | Tribapay | Varies | None | Naira |

16 | Fundall | Free/$2 | None | Naira ($5 min) |

17 | Bitnob | $1 | $1 (if < $100) | Naira, crypto |

18 | Eyowo | $2 | None | Naira |

19 | Eversend | Free | $1 | $1 min top-up |

20 | Gomoney | Free/(< $1) | None | Naira |

21 | Nearpays | $2 | None | Naira |

Curious about which provider suits your unique needs? Keep reading as we dive into what makes each of these cards stand out.

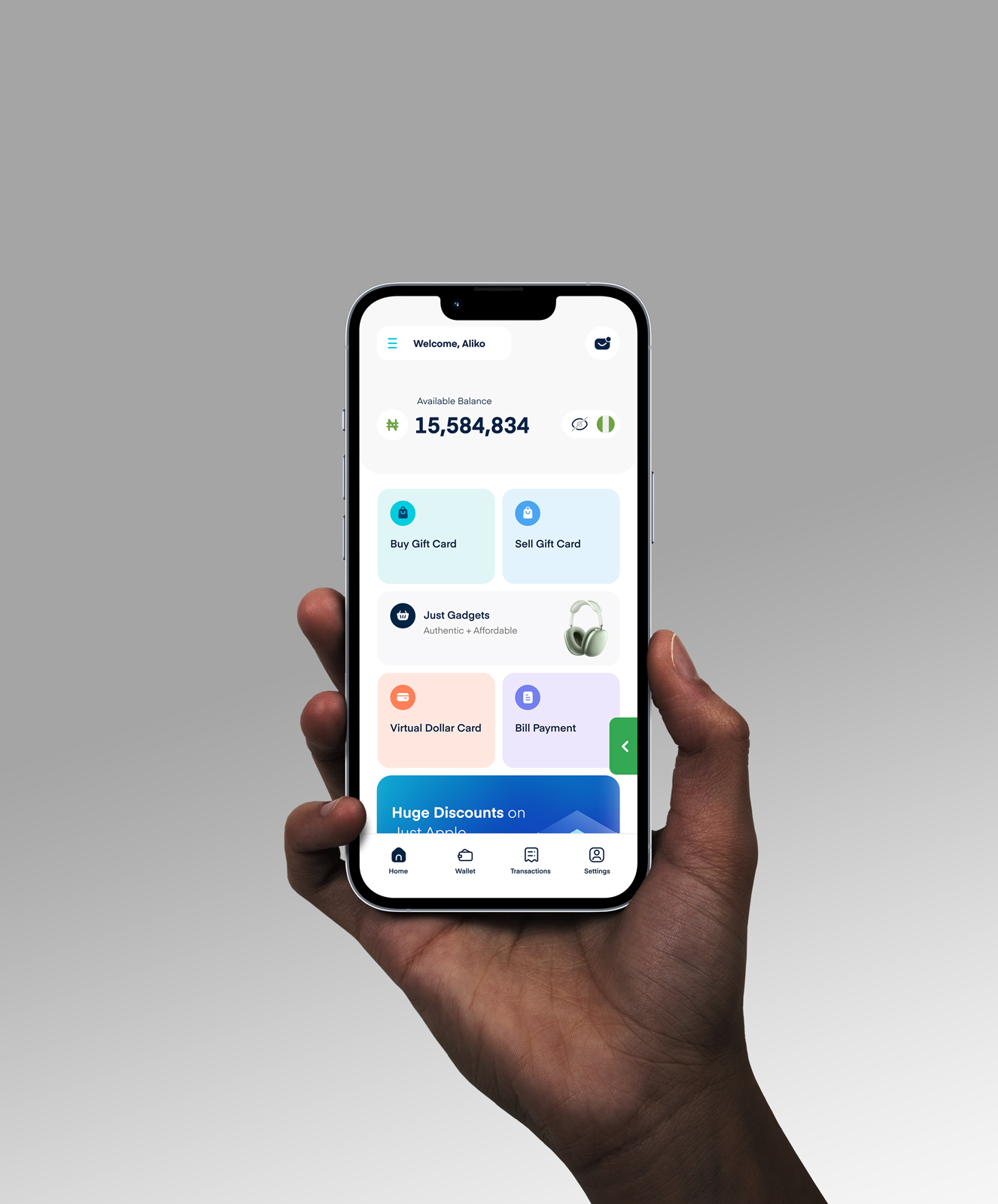

1. Cardtonic

Cardtonic is a leading fintech company in Nigeria and Ghana, offering a wide range of services, including buying and selling gift cards, paying bills, purchasing gadgets, and providing virtual dollar cards for seamless international transactions.

The virtual dollar card from Cardtonic stands out for its affordability and flexibility. It allows users to fund the card in Naira at some of the best conversion rates in the market, making it an excellent option for international payments.

Furthermore, the card is globally accepted across major platforms like Amazon, Adobe, Aliexpress, Airbnb, Apple Music, Canva, Coursera, Capcut, ChatGPT, eBay, Facebook, Fiverr, Hulu, Instagram, Linkedin, Microsoft, Medium, Netflix, Paypal, Spotify, Shein, Starlink, Temu, TikTok, Twitter (X), Upwork, Udemy, YouTube, Zoom e.t.c. Users are only charged a $1.5 card creation fee, with no maintenance charges, making it both cost-effective and hassle-free.

Getting a virtual dollar card on Cardtonic is simple. Just sign up on the Cardtonic app, complete your KYC process, and fund your wallet. Once that’s done, you can create your virtual dollar card in a few easy steps and start making payments immediately.

If you need further clarification, watch the video below for a detailed guide on how to get a virtual dollar card on Cardtonic.

2. Vesti

Vesti provides a virtual dollar card for fast and secure international payments. Accepted on over 100 platforms, the card can be funded with $10 from your Naira wallet and has a $10,000 monthly spending limit.

The Vesti app lets users manage transactions, view balances, and delete compromised cards. It’s a reliable option for anyone looking to save on currency conversion and make hassle-free global payments.

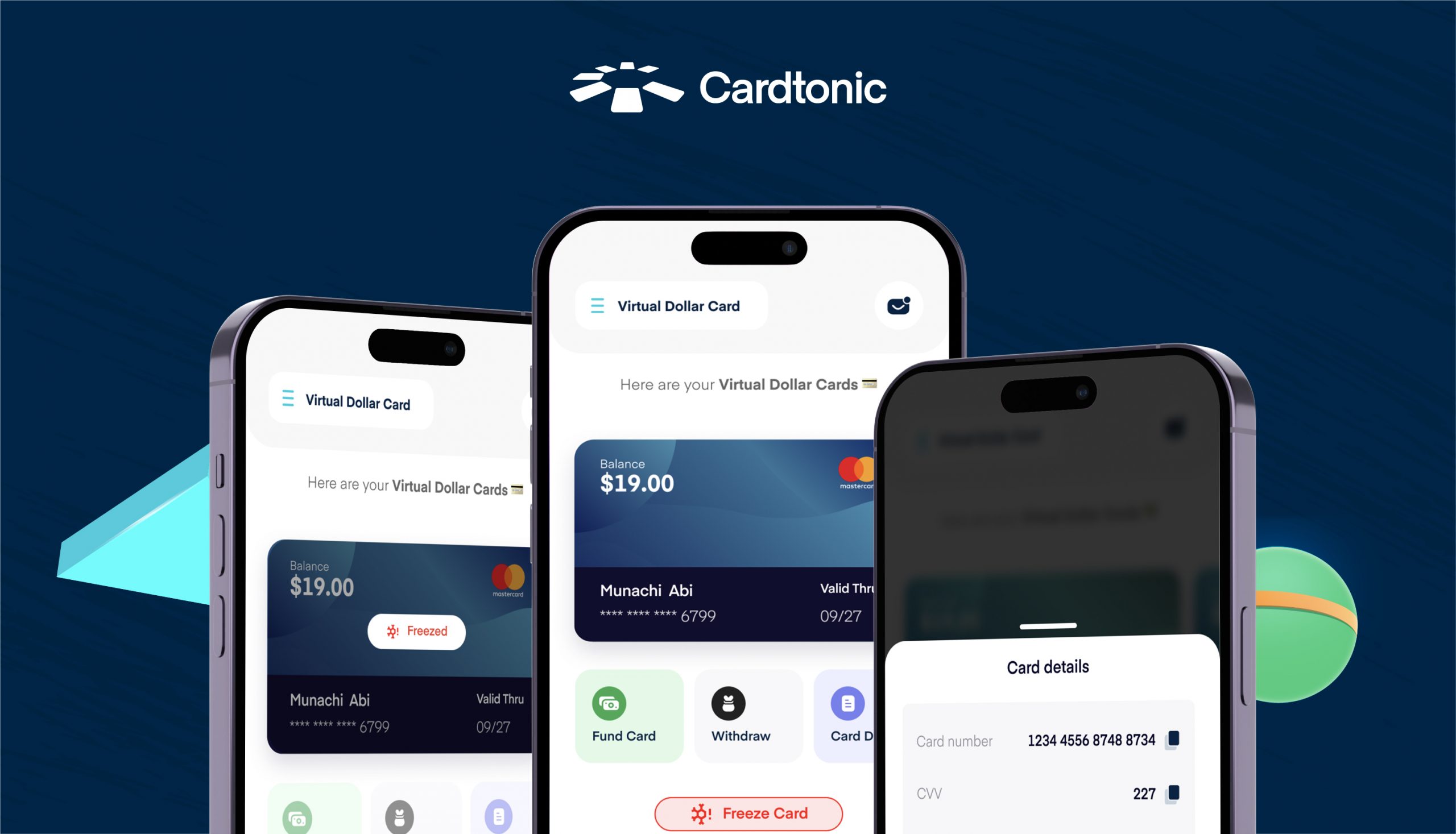

3. GeePay

GeePay by Raenest offers virtual dollar cards in USD, GBP, and EUR for international transactions. It’s ideal for freelancers and business owners, allowing payments on platforms like PayPal and Payoneer.

The card costs $3 to create, and you need at least $2 to fund it. GeePay also supports withdrawals to local banks and mobile money accounts in over 100 countries, making it a versatile choice for global payments.

4. Grey

Grey makes international payments easy with its virtual dollar card. Supporting multiple currencies like NGN, USD, and GBP, it’s perfect for flexible global transactions. Creating a card costs $4, but you get $1 back in your account. You can fund it with as little as $2 or go up to $2,500 per transaction.

Grey stands out with zero maintenance fees and competitive exchange rates. Whether it’s shopping or subscriptions, this card gets the job done without stress.

5. Chipper Cash

Chipper Cash offers a 3D-secured virtual dollar card designed for stress-free international payments. It’s widely accepted on platforms like Spotify, Netflix, and Apple. Creating a card costs $3, with a $1 monthly maintenance fee.

The Chipper Cash app makes it easy to fund and manage your card, whether you’re shopping, subscribing, or sending money across borders.

6. Cardify

Cardify Africa’s virtual dollar card is built for flexibility and ease of use. You can fund it with Naira, BinancePay, or Paxful and use it on platforms like AliExpress, eBay, and Amazon.

Creating a card costs just $2, and there are no maintenance fees to worry about.

7. PSTNET

PSTNET’s virtual cards are tailored for specific needs like advertising and online shopping. They work seamlessly on platforms like Facebook Ads, TikTok, and Google. Depending on the type of card, fees range between $7 and $10 monthly.

You can fund the card with cryptocurrency, and the app offers tools to track spending and download transaction histories. PSTNET is ideal for businesses and individuals running campaigns or managing international payments.

8. Zole

Zole offers a virtual dollar card that’s quick to set up and easy to use. For just $2, you can create a card that’s valid for three years with no maintenance fees. However, there’s a 0.5% transaction charge.

Zole’s card works on platforms like Amazon, Udemy, and Coursera, making it ideal for shopping, learning, or even hosting services.

9. Klasha

Klasha’s virtual dollar card is a no-brainer for anyone shopping internationally or running a business. Accepted on platforms like Shein, AliExpress, and Netflix, it’s easy to use and affordable—just $2 to create.

You can fund the card directly from your wallet on the Klasha app and enjoy competitive exchange rates. The app also keeps you organised with spending analytics, real-time transaction notifications, and detailed histories.

10. Bitsika

Bitsika makes international payments super simple with its virtual dollar card. You can fund the card using either Naira or cryptocurrency, giving you plenty of flexibility. The card works on global platforms, making it great for things like online shopping or subscriptions.

It costs just $3 to create, and there are no maintenance charges. Plus, the Bitsika app makes managing your card and tracking transactions a breeze.

11. Dantown

If you need a reliable virtual dollar card, Dantown has you covered. Accepted on platforms like eBay, Netflix, and PayPal, it’s a great option for shopping or handling global payments.

You can fund it with Naira or cryptocurrency, so it’s flexible too. The card costs $2 to create, and there are no monthly fees.

12. Changera

Changera’s virtual dollar card, powered by Bitmama, is perfect for anyone managing global payments. It supports Naira, Euros, and Pounds, making it versatile for different currencies.

You can hold up to $10,000 monthly on the card and fund it without a minimum amount. It’s great for PayPal transactions and other international platforms.

13. ALAT by Wema

Wema Bank offers its virtual card to facilitate online purchases and payments for subscription services like Netflix, iTunes, and Spotify without needing a physical card.

The cards work well across popular apps and platforms, and users are not charged unnecessary fees. You can quickly create, manage, liquidate or even block your virtual card within the Alat app.

14. Spectrocard

Spectrocard is a solid choice for global payments and subscriptions. Whether you’re shopping on Amazon or running Facebook Ads, this card makes transactions easy. It costs $3 to create, and there are no hidden charges or maintenance fees.

Business owners and freelancers will love the detailed transaction reports you can download straight from the app. You can also fund your card with Naira or cryptocurrency, giving you even more options.

15. Tribapay

Tribapay makes managing global payments easy with its virtual dollar cards. These cards are accepted on platforms like PayPal and e-commerce sites, offering flexibility for online transactions.

You can create multiple cards, fund them, and set spending limits directly through the Tribapay app. The ability to link cards to PayPal accounts and adjust PINs ensures added security.

16. Fundall

Fundall is a one-stop platform for Nigerians, offering virtual dollar cards that simplify international payments. You can create multiple cards, with the first card being free and subsequent ones costing just $2. A minimum of $5 is required to fund the card, which works seamlessly on platforms like Amazon, eBay, and Alibaba.

Fundall’s virtual cards ensure secure and convenient global transactions, making them a great choice for freelancers and online shoppers.

17. Bitnob

Bitnob gives you a virtual dollar card that’s perfect for both fiat and cryptocurrency users. Creating a card costs just $1, and you can fund it with up to $10,000. For top-ups under $100, you’re charged $1, while amounts above $100 attract a 1% fee.

The card is widely accepted across several African countries, including Nigeria and Kenya. What’s more? You can even customise your card’s colour, name, and description, adding a personal touch to your transactions.

18. Eyowo

Eyowo keeps things simple and secure with its virtual dollar card. You can use it for payments on Spotify, Google Play, or Netflix, and enjoy competitive exchange rates when you fund it with Naira. Creating a card costs $2, and there are no recurring fees.

The Eyowo app makes life easier by letting you track spending, freeze your card, or delete it if necessary.

19. Eversend

Eversend offers a virtual dollar card with transparent exchange rates and no hidden fees. The card is free to create, but you’ll need a $1 minimum top-up and a $1 monthly maintenance fee.

It works across Africa, the UK, and Europe, making it great for international payments.

You can create multiple cards, freeze or delete them if compromised, and enjoy added security. Eversend also charges $0.35 for failed transactions due to insufficient funds.

20. Gomoney

Looking for a budget-friendly virtual dollar card? Gomoney offers one for free when you create your first card. If you need additional cards, each one costs ₦850. With this card, you can securely pay for services like Apple Music, Coursera, or Amazon without restrictions.

There are no monthly maintenance fees, making it a cost-effective option. Plus, the app provides a transparent breakdown of your spending, allowing you to track transactions in real-time.

However, keep in mind that Gomoney has a $100 monthly spending limit per user, regardless of how many virtual cards you generate.

21. Nearpays

Nearpays is the perfect choice for freelancers and businesses dealing with international clients. The virtual dollar card is globally accepted and supports payments on platforms like PayPal, Netflix, and Amazon.

It costs $2 to create, and there are no extra charges to worry about. You can fund it with Naira at great exchange rates, and the app lets you track transactions, set spending limits, and even freeze the card if needed.

Frequently Asked Questions About Virtual Card Providers in Nigeria

1. What Is A Virtual Dollar Card?

A virtual dollar card is a non-physical card denominated in US dollars used to make international payments online for products and services. Virtual USD cards look and work almost like physical cards, but they are generated from payment wallet apps and loaded with funds to make US dollar payments.

2. How Do I Get A Virtual Dollar Card In Nigeria?

To get a virtual dollar card, you must sign up with any reputable virtual card provider like Cardtonic, complete your KYC (Know Your Customer) procedure and generate a virtual card from the app.

3. What Documents Do I Need To Get A Virtual Dollar Card?

Generally, you will require your Bank Verification Number and a valid ID card to complete your KYC procedures.

4. Are There Any Fees Associated With Virtual Dollar Cards?

Some providers may charge maintenance fees, issuance or transaction fees. You must confirm with your provider.

5. What Happens If My Virtual Dollar Card Expires?

If your card expires, you must generate a new one from the app after paying an issuance fee. The expiration date is typically found on your virtual card.

6. What Is The Best Virtual Dollar Card In Nigeria?

The best virtual dollar card in Nigeria is the Cardtonic virtual card. It’s reliable, affordable, and works seamlessly for international purchases, online shopping, and payments. With both Visa and Mastercard options, it ensures global acceptance and a hassle-free experience.

Conclusion

Virtual dollar cards are a game-changer for accessing global goods and services—they’re convenient, secure, and solve the hassles of international payments.

Choosing the right card depends on your needs, whether it’s low fees, wide acceptance, or ease of use. But if you’re asking me, I’d recommend the Cardtonic virtual dollar card.

It’s affordable, reliable, and works seamlessly with both Visa and Mastercard options. In my opinion, it’s the best virtual dollar card in Nigeria for anyone looking for a dependable solution.