Can You Use PayPal in Nigeria? Here’s the Truth in 2026

The first time I landed a client from outside Nigeria, I felt like I’d finally made it. After we agreed on the project, my client said, “Once you’re done, I’ll pay you through PayPal. Do you have a PayPal account?”

That’s when my excitement froze. I thought, “Wait… can I even use PayPal in Nigeria?”

I’d always heard about PayPal—how it’s supposed to be the easiest way to get paid online. But here in Nigeria, everyone has a different story. Some say it works, others say, “Don’t even bother,” and nobody gives you the full gist.

So, I decided to figure it out myself. And honestly, using PayPal here isn’t as simple as those foreign YouTubers make it seem. There are a few extra steps, some surprises, but also solid ways to get your money.

If you’re stuck on how PayPal works in Nigeria, you’re not alone. Here’s everything I found out.

Is PayPal Available in Nigeria?

When I started my PayPal research, I was surprised to find out you can actually open a PayPal account in Nigeria.

Just visit the PayPal Nigeria website, sign up, and link your card. Sounds easy enough, right? But here’s the catch: with a Nigerian personal PayPal account, you can only send money or shop online. You can’t receive payments.

That means if a client wants to pay you for your hard work, the regular Nigerian PayPal account won’t do the job. This limitation comes down to PayPal’s rules for Nigeria, mostly to control fraud and comply with local banking regulations.

So, while you can enjoy the benefits of shopping or paying online, getting paid isn’t so straightforward.

The good news? There are workarounds, especially if you’re willing to set up a PayPal Business account or use some smart alternatives. But before I get into those, here’s exactly how to open a PayPal account in Nigeria and what you can (and can’t) do with it.

How to Open a PayPal Account in Nigeria 2026

You can open a PayPal account in Nigeria by signing up on the PayPal website, choosing either a personal or business account, filling in your details, and linking a Visa or Mastercard.

1. Visit the Nigerian PayPal website (paypal.com/ng).

2. Click “Sign Up” and choose either a Personal or Business account. (If you’re a freelancer or plan to get paid, go for Business.)

3. Fill in your details: Name, email, phone number, address, and create a password.

4. Link a Visa or Mastercard (Nigerian Verve cards don’t work, don’t bother trying).

5. Verify your email through the link PayPal sends to your inbox.

6. Confirm your card by approving the small verification charge PayPal makes (usually $1.95 or less).

Expert tip: With a personal account, you’re limited to sending money and shopping. If you want to receive payments (which, let’s be honest, is the main reason you’re here), a business account is the way to go.

What Can You Do with PayPal in Nigeria?

With a Nigerian PayPal account, you can send money, shop on international websites, and pay for digital services. However, to receive payments, you’ll need a business account and some extra steps.

How to Send Money on PayPal

To send money with PayPal in Nigeria, log into your account, click “Send,” enter the recipient’s email, choose the amount, select your payment method, and confirm.

1. Log in to your PayPal account either on the website or the app.

2. Click on “Send”—you can’t miss it on the dashboard.

3. Enter the email address of the person you want to pay (make sure it’s the one linked to their PayPal account).

4. Type in the amount and select the right currency for your recipient.

5. Choose your payment method—Visa, Mastercard, or a linked bank account.

6. Finally, review all your details and hit “Send.”

I’ve used this process many times to pay for tools and subscriptions, and it’s always quick. PayPal will even send you a confirmation email for every transaction, so you’re never left guessing whether your money went through.

How To Receive Payment On PayPal

To receive payments on PayPal in Nigeria, you’ll need to open a business account, link a virtual dollar card, and share your PayPal email with clients.

1. Create a PayPal Business Account

Go to paypal.com/NG, click “Sign Up,” and pick “Business Account.” Use your name if you’re a freelancer, fill in your email, phone, and address, and set a password.

Pick “Individual/Sole Proprietor” if it’s just you, describe what you do, then verify your email.

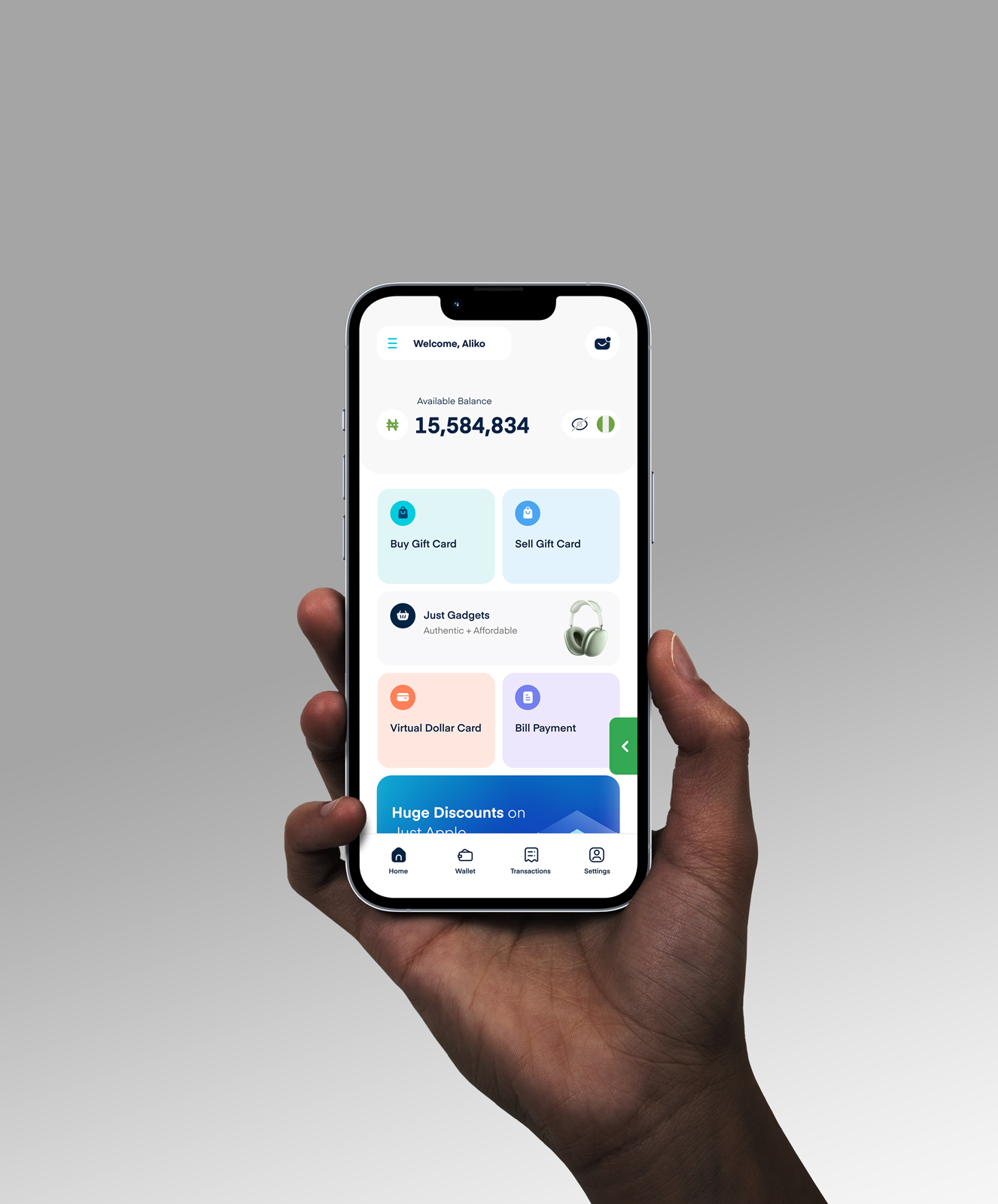

2. Get a Virtual Dollar Card

Most Nigerian cards don’t work with PayPal, so you’ll need a virtual dollar card. I got mine from Cardtonic.

All I had to do was sign up on Cardtonic, tap on “Virtual Dollar Card,” fund the card with Naira, and my card details appeared instantly. It’s fast, reliable, and works perfectly for PayPal.

If you need a full breakdown, read this simple guide on how to get a virtual dollar card on Cardtonic.

Want to see exactly how it works? Watch the video below for the real step:

3. Link Your Card to PayPal

Log in to your PayPal account, go to “Wallet,” and click “Link a Card.” Enter your Cardtonic virtual dollar card details. PayPal will charge a small fee (usually around $1.95) to verify your card.

Next, check your card transaction history for a four-digit code that comes with the PayPal charge. Enter this code back on PayPal to confirm your card.

Once you enter the code, PayPal will verify your card, and you’re good to go. Your account can now send and receive payments.

4. Send Your PayPal Email to Clients

Share your PayPal business email with your client. That’s all they need to send you money. Once they pay, you’ll see it reflect in your PayPal balance.

5. Access or Convert the Funds

Congrats, you’ve solved the receiving part—your PayPal balance is looking sweet. But there’s a catch: you can’t withdraw directly to a Nigerian bank account.

Don’t panic; there’s still a way. Most Nigerians (myself included) use platforms like Flutterwave or Grey. Just link one of these to your PayPal, transfer your funds over, and then withdraw straight to your bank. Simple.

Limitations of Using PayPal in Nigeria

While you can use PayPal in Nigeria to shop and send money, receiving payments and withdrawing funds to a local bank come with strict limits, higher fees, and card compatibility issues.

1. No Receiving with Personal Accounts

This is the part that surprises a lot of people, even me. If you open a personal PayPal account in Nigeria, you can’t receive money.

You can send money, shop online, and even link your debit card, but you won’t be able to get paid. So if you’re a freelancer, business owner, or someone expecting payment from abroad, that personal account just won’t work.

2. No Direct Withdrawal to Nigerian Bank Accounts

Getting money into your PayPal is one thing; getting it out is another. PayPal won’t let you withdraw straight to any Nigerian bank account.

After getting paid, I had to use platforms like Grey or find trusted local exchangers to move the funds. It’s an extra step, but it’s the only way that’s worked for me and plenty of other Nigerians.

3. Limited Card Compatibility

Forget about using a Verve card. PayPal only works with Visa and Mastercard, and your card needs to be enabled for international transactions.

I’ve had cards declined before, but it turns out some banks block international transactions by default. Using a virtual dollar card (like Cardtonic’s) solved this problem for me.

4. High Currency Conversion Rates

PayPal’s exchange rates will eat into your earnings if you’re not careful. I’ve lost up to 4% of my payment in conversion fees alone.

Let’s say $100 should be ₦150,000 at the real rate. PayPal might give you ₦144,000 instead. Over time, those small differences add up.

5. Slightly Higher Overall Fees

To be honest, PayPal can be expensive when you’re using it from Nigeria. Besides the currency conversion charges, you’ll also notice that transaction fees are often higher than what users in other countries pay.

From my own experience, PayPal’s fees aren’t always obvious at first—they really start adding up over time. Here’s a simple table showing the main fees you should expect with each transaction:

s/n | Charge Type | Details |

1. | Currency Conversion Fee | PayPal adds about 4% on top of the standard exchange rate. If $1 is ₦1,500, you might get ₦1,440. |

2. | International Transaction Fee | Up to 5% of the amount received or sent. For example, PayPal takes $5 out of every $100 you get. |

3. | PayPal Service Fees | Varies based on the transaction—sending, receiving, or converting. Business payments may attract extra fees. |

4. | Card Charges | Your Nigerian bank may charge ₦100–₦300 for every international PayPal transaction or verification. |

Workarounds and Alternatives for Receiving Payments

If you can’t receive PayPal payments directly in Nigeria, try using a PayPal business account, opening an account in a supported country, or using alternative payment methods like gift cards.

1. Open a PayPal Account in Another Country

Some Nigerians open PayPal accounts in countries like the US, UK, or UAE, where full features are available. You’ll need a foreign address, a phone number, and a card or bank account from that country. Even though it works, it’s risky.

PayPal can ban your account if it suspects you don’t actually live there. I know people who got away with it for months and others who got their funds locked overnight. If you try this, do it with your eyes wide open.

2. Use Payment Gateways Like Grey

Grey offers you a virtual USD, GBP, or EUR bank account. You can connect it to your PayPal account and receive payments just like someone in the US or UK would.

I’ve used Grey myself—the process is smooth, and withdrawing to my Nigerian bank was easy and fast. This is one of the most reliable options for freelancers and remote workers in Nigeria.

3. Flutterwave Payment Links (For Businesses)

If you run a business, you can enable PayPal on your Flutterwave checkout or payment link. Your client pays you through the link, and Flutterwave collects the payment (including via PayPal), and you withdraw it to your Nigerian bank account.

Not every account gets this feature by default. You have to apply and get approved as a business. For those who qualify, it’s a game changer.

4. Trusted Local Exchangers

There are peer-to-peer exchangers that will buy your PayPal funds and pay you in Naira. This is a last resort for some, but it works if you use a verified, trusted exchanger.

Always do your homework and check reviews before sending your money anywhere.

5. Gift Card Alternative

If PayPal is giving you wahala and your client is flexible, ask them to pay with an international gift card (like Amazon, Google Play, Apple, or Steam).

You can sell that card on Cardtonic and get your Naira in minutes. It’s fast, simple, and skips all the PayPal headaches.

Frequently Asked Questions About Using PayPal in Nigeria

1. Can Nigerians Withdraw PayPal Funds to Local Banks?

No, Nigerians can’t withdraw PayPal funds directly to local bank accounts. PayPal doesn’t support withdrawals to Nigerian banks at all. Most people use platforms like Grey or Flutterwave to receive PayPal payments, then transfer the money to their Nigerian bank account.

2. How Do I Receive International Payments as a Freelancer?

There are a few smart ways that actually work in Nigeria. You can receive crypto from your clients and sell it on Breet for Naira. You can also ask for international gift cards (like Amazon or Apple), then sell them on Cardtonic and get paid in Naira.

3. What is the Best Card to Use With PayPal in Nigeria?

The best card to use with PayPal in Nigeria is a virtual dollar card. Virtual dollar cards are reliable for linking to PayPal and work smoothly for international transactions.

4. How Much Money Can You Receive on PayPal Without Being Verified?

If your PayPal account isn’t verified, you’ll have limits on how much you can receive, send, or withdraw. While the exact limit can vary, most unverified accounts are capped at about $500–$1,000.

To remove the cap, just link a card, verify your email, and provide the requested personal or business info.

5. Which Nigerian bank Works With PayPal?

No Nigerian bank fully integrates with PayPal for receiving money. But some Visa and Mastercard debit cards from banks like UBA, GTBank, and Access Bank might work for linking to your PayPal account for making payments.

6. Can I Use PayPal Without a Bank Account?

Yes, you can use PayPal without linking a bank account, but you’ll be limited to sending money and making online payments. You won’t be able to withdraw funds from your PayPal account.

Conclusion

So, can you use PayPal in Nigeria? Yes, but you have to play by a different set of rules.

You can send money, shop online, and even receive payments if you set up a business account and use the right card. The process isn’t as smooth as what you see abroad, but it’s doable with a little patience and the right tools.

Just remember the key points: use a virtual dollar card, know your limits, and have a plan for getting your money out. And if PayPal ever gives you a headache, there are always alternatives like Grey, Flutterwave, or even gift cards.

Once you understand how it works, getting paid from anywhere in the world doesn’t have to be stressful. Good luck—and enjoy your funds!