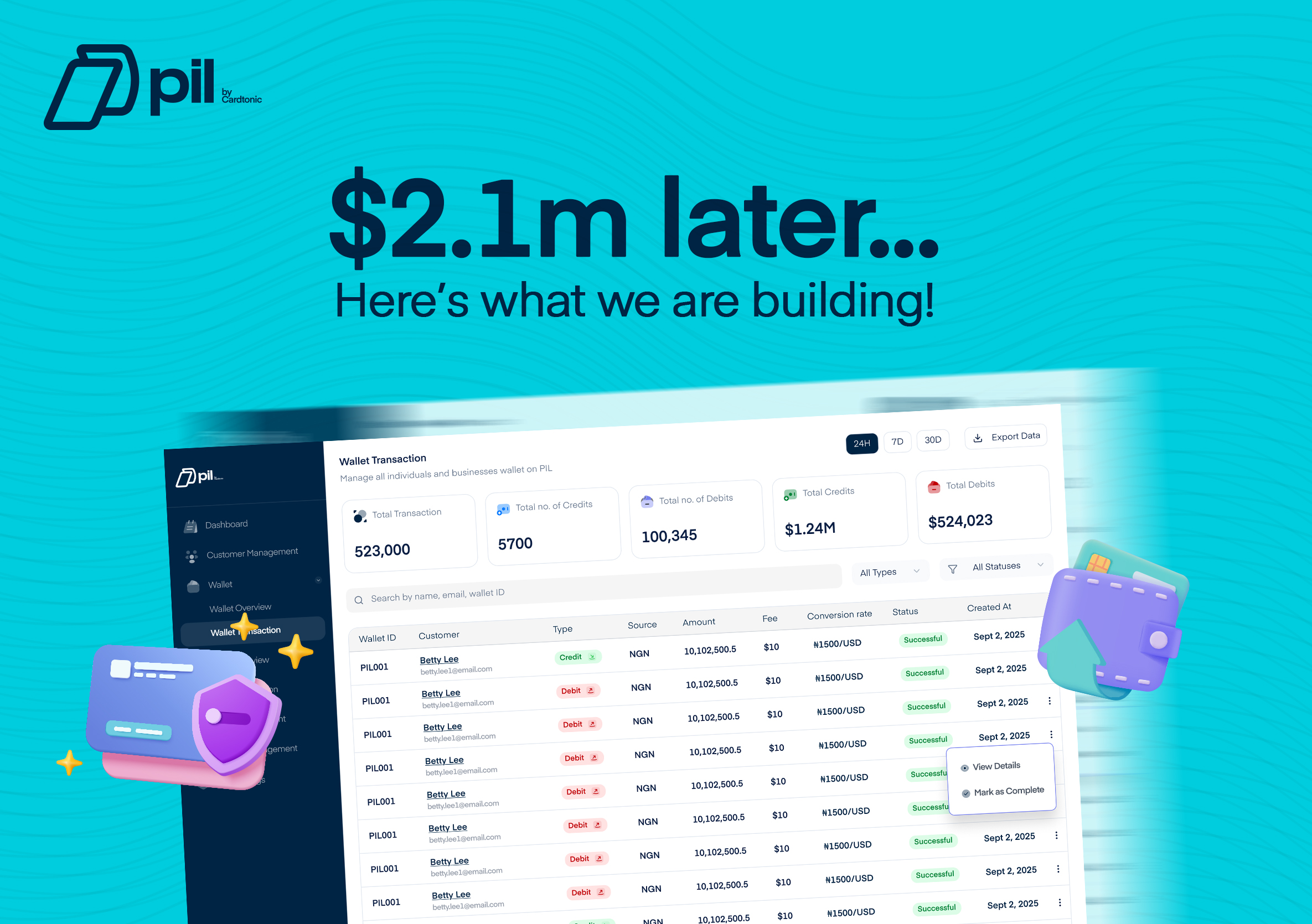

We Raised $2.1M To Build The Future Of Business Spending: Meet PIL by Cardtonic

Once Upon A New Build

Here’s something you don’t hear every day:

A proudly bootstrapped company wakes up one morning, looks at its data, its growth, its ambitions…and says, “Alright. It’s time to raise $2.1 million for something new.”

But that’s exactly what happened.

A few things were clear from the start: we wanted to serve businesses, we had our eyes on remittance, and we figured out the name pretty quickly too.

Fresh from the oven, that’s how Pil by Cardtonic became a thing—a B2B card spend management platform built for businesses running high-volume operations. With Pil, businesses can fund their cards with Naira, Cedi, or stablecoins, give their team controlled access, and keep track of everything. In other words, all the spending and all the accounting is on display in a single place.

“So…Pil?”

Ask our founders who named Pil and you’ll get two different stories and one dramatic side-eye. But everyone agreed on one thing: Pil.com just made sense. It felt clean, simple, light as a feather, and most importantly, aligned perfectly with the philosophy we wanted this product to embody.

Before Pil rose to the top, we entertained other names; some decent, some questionable, and some we immediately pretended we never said out loud. Pil eventually stuck, and we moved to focusing on what mattered the most next: building.

Why a $2.1M Funding — After Years of Saying No

We have always had a quiet discipline at Cardtonic. We’ve never had a fundraiser, or needed to.

(What is a pitch deck? Or pitch meetings? Not for us, that’s what.)

For years, we built everything by bootstrapping straight from the pockets of our founders, and then from revenue.

But we’ve decided to do Pil differently from the get-go.

Why? We figured pretty quickly that Pil needed to run on firm rails: compliance strength, liquidity, and the kind of infrastructural backbone that doesn’t come cheaply. Bootstrapping teaches precision, but precision alone cannot build global-scale systems.

Pil needed space; first to exist, and then — quickly too — to grow into what it truly could be.

We could have done this alone, but we decided not to.

We raised $2.1M from angel investors who had seen our work up close for years. We didn’t need to sell an idea; it felt more like inviting people into a story whose plot they already understood. (#Quiet Trust!)

Internally, this raise confirmed something we already sensed: we had crossed the threshold from “product builders” to “infrastructure builders.” We’d matured into a company capable of supporting deeper markets on wider playing fields.

Pil is not a side project; it’s a platform with the potential to serve the businesses with the same reliability that earned us millions of retail users.

Why Pil Had to Stand Alone

Our retail users taught us many things, like adaptability. These users are wonderful, but their usage patterns shift every day. One-time transactions. Small to medium-sized top-ups.

Businesses, however, move differently: They spend with rhythm. They have recurring expenses. They operate on budget sheets, approvals and accounting cycles. Their pain points aren’t emotional; they are operational.

Mixing these two worlds within one product would only hold both back.

Pil needed a home built for businesses from the ground up.

Pil in a Crowded Market

Every 2-4 business days, a shiny new fintech product shows up on the shelves. But a crowded market wasn’t a warning sign for Pil; we considered it proof of demand. The real advantage isn’t about being the first but being the product that understands the user the best.

Most fintech startups try to “upgrade” consumer tools for business use. But businesses don’t want upgraded tools; they want purpose-built systems.

That’s what Pil is.

A business-first platform that understands spending controls, team management, predictable limits, visibility for finance teams, and the emotional relief that comes from tools that simply work.

We’re not guessing what businesses want. Not us.

As builders who were once in need of this exact product, we have insight and foresight. Pil’s MVP solves the biggest pain point for our target market: reliable cards for teams that spend heavily.

But the roadmap is intentionally bigger. We’re planning for physical cards, specific business departments, smart automated expense flows, deep integrations with QuickBooks, Xero, Zoho, an API, and more.

Pil is on track to become the operating system for business spending across teams, enterprises, agencies, and startups.

What We Learned From Cardtonic That Built Pil

Two lessons became the backbone of Pil’s philosophy:

First: Whatever we do, we’ll make sure we’re solving real user pain, not assumptions. Shiny tricks and guessworks are tempting, but they don’t matter much if they don’t actually help people.

Second: We know to always keep support fast and human. In the fintech sector, users have little patience to spare and money matters cannot be made to wait, ever.

Confidence Running On More Than Coffee

Last week, over coffee (we cornered him for this one!), we asked one of our co-founders what fuels his confidence in Pil. He served his answer hot:

“Because we’ve lived through the exact problem ourselves. As a company, we spend tens of thousands of dollars every month on ads, tools, and subscriptions. And we’ve felt all the pain points firsthand: funding bank cards is stressful, limits are random and unpredictable, and payments fail when you need them the most. We tried multiple platforms for years, even the ones with ridiculous fees, simply because we had no better option. Eventually, we built our own internal solution just to keep our operations stable. That internal solution is now the foundation of PIL. So, this confidence comes from experience, not theory.”

In summary? Pil isn’t us “testing the waters”. It’s muscle memory. We remember what did not work for us, so we know what does.

Pil exists because the demand first found us. We’ve lived through needing this product when it didn’t exist.

And now? We’re doing something to make sure no other business has to.