Why and How We’ve Stayed Self-Funded – Cardtonic

Earlier this year, as we prepared for our masterclass session at Africa Tech Summit Nairobi, ES suggested a bold focus: Cardtonic’s pathway to profitability and growth without external funding.

It was the perfect call. After all, we are a six-year-old self-funded company with more than 120 employees, and if anyone is qualified to talk about this, it’s us.

And here’s the tea.

How It Started

Back in 2018, our founders put down ₦5 million of personal savings. No pitch deck. No investor calls. Just two founders betting on revenue as fuel and discipline as their compass.

That decision forced every move to answer one question: how does this bring in money?

It meant running lean. Every campaign had to tie directly to results. Every hire had to justify itself. Growth was steady, sometimes slow, but always sustainable.

The Turning Point

Then came 2022. Nigerian banks slashed card limits for international payments to just $20. What looked like a setback for most became a breakthrough for us. Suddenly, more individuals and businesses leaned on gift cards for international transactions.

Because we had been disciplined and grounded in cash flow, we were ready. That shift became one of the biggest accelerators of our growth.

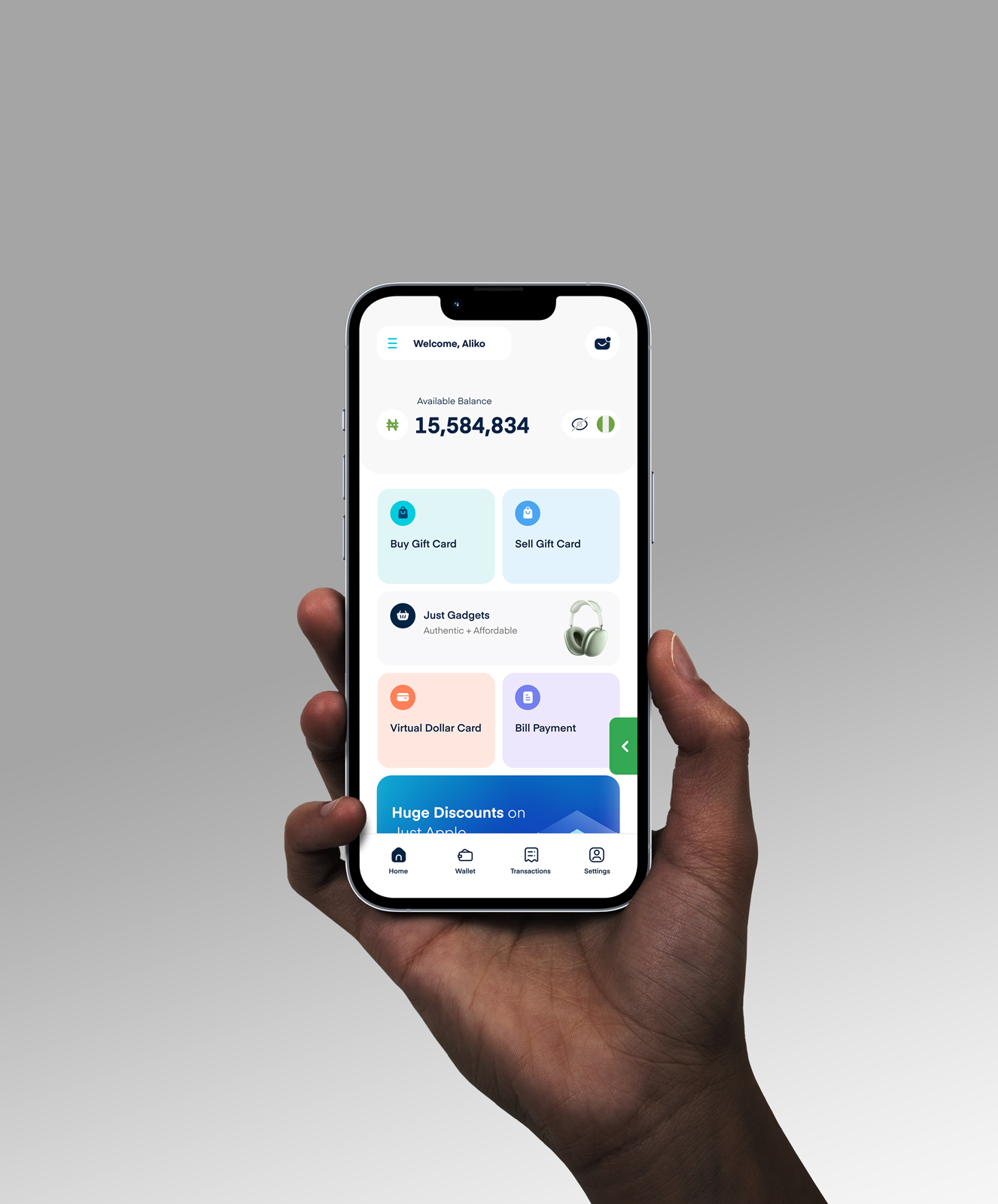

By 2024, the same philosophy birthed our Virtual Dollar Card, now responsible for more than half of our revenue. Different product, same principle: solve real problems profitably.

Why We Chose This Path

Bootstrapping wasn’t about fear of rejection. It was about control and intentionality.

- Control to avoid vanity marketing campaigns.

- Control to avoid unnecessary spending.

- Control to grow responsibly.

- Control to protect the culture that now powers 120+ employees and serves 1.5M+ users.

For a long time, we never explored certain forms of paid marketing. Every Naira we had went into product and operations, while our growth relied almost entirely on organic efforts.

The logic was simple: if we could achieve long-term, compounding results with organic channels, why pay for short bursts of attention?

It forced us to get really good at things like SEO, community building, and storytelling. These weren’t just cheaper, they built trust, brand equity, and a loyal customer base that money alone couldn’t buy.

Sure, raising money might have meant faster expansion or louder campaigns. But what we’ve built instead is resilience and “cutting our coats according to our clothes”.

We wanted to build a company that exists regardless of external funding, not because of it, and we have, so far.

The Takeaway

Six years in, we can say it clearly: self-funding has been our superpower. It kept us logical, grounded, and in charge of our own story.

So, are we raising? Maybe someday. Or maybe never. Until then, we’ll keep doing what has worked from day one: staying disciplined, staying logical, and staying in control.