5 Common Online Shopping Payment Issues and How Cardtonic Solves Them

I still remember this day when I decided to upgrade my wardrobe and get some new clothes on Temu. I spent hours picking, unpicking, and then adding the ones I finally fell in love with to the cart. Only for me to get to the checkout to pay for them, and then I got hit with the “Transaction declined” error message.

Tried over and over again, the same error message. You can imagine how frustrated I was.

I decided to surf the internet to find ways to solve this problem. I found an article talking about virtual cards and Cardtonic came out as one of the top ones. I decided to give it a try and hey! I was totally stunned.

What I had been trying to pay for for hours, got completed in a twinkle.

So, in this article, I’ll be talking about the top 5 most common online shopping payment issues and how Cardtonic could help you solve them.

Top 5 Issues In Cross-Border E-Commerce Payments And How To Solve Them

The common online shopping payment issues include card rejections on global sites, low international spending limits, hidden maintenance fees, security concerns, and unpredictable network downtime. Cardtonic solves them by providing virtual cards that are globally accepted, with high daily transaction limits and 24/7 network availability.

| S/N | Issue | Typical Local Bank Card | Cardtonic’s Fix |

| 1. | Card Rejection on Global Sites | Mostly Incompatible | Works on virtually all global shopping platforms |

| 2. | Low International Limits | $1,000 – 2,000 per quarter | Up to $50,000 daily limit |

| 3. | Unpredictable Network Downtime | More frequent with local banks | Infrastructure built specifically for international transactions |

| 4. | Hidden Maintenance Fees | Monthly maintenance, currency exchange, and cross-border transaction fees | One-time card creation fee with a $0 monthly maintenance fee |

| 5. | Security Concerns (Fraud) | Card typically linked to local bank account | Unique virtual card created |

1. Card Rejection on Global Sites:

The issue with card rejections on many global sites is that they have something called BIN (Bank Identification Number) filters.

If your card is not from a supported region or does not have the ‘3D Secure protocols’ that most international vendors require, the transaction will usually be automatically declined.

Cardtonic steps in here by providing you with virtual dollar cards issued by global providers. Because these cards are widely accepted for international payments, they just “work” on sites where local cards will typically fail.

Even better, Cardtonic now has a new type of card called Platinum cards, that is even more impressive than the regular virtual cards. With it, you can enable the contactless tap-to-pay feature, where you don’t have to enter your card details before paying. Just literally ‘tap’ and ‘pay’. Cool, right?

2. Low International Limits:

This is one of the biggest issues shoppers encounter when they want to purchase items on international platforms.

Though local banks have now increased the international spending limit on naira cards from the old $20-50 limit to around $1,000-2,000 per quarter (depending on the bank).

Let’s be real. If you’re a business owner running global ads or someone who likes to bulk-shop, $1,000 over three months is still very restricting.

One big purchase and your hands are tied for the next 90 days!

Cardtonic steps up the game with daily limits expanded to up to $50,000 and unlimited cumulative funding limit.

So, whether you want to pay for a $30 subscription or you’ve got a high-volume business transaction to execute, you can fund your virtual card through your wallet and spend freely!

3. Unpredictable Network Downtime:

Though Naira cards may be back for international transactions, we will still agree that the infrastructure behind them is largely still catching up.

Throughout late 2024 and early 2025, a lot of major local banks went inactive and had service disruptions that lasted days (and even weeks for some) because of said “core system migration and technical upgrades”.

Cardtonic’s infrastructure is cloud-native and it is designed specifically for international and high-velocity digital payments.

So, you can always be assured whenever you’re ready to click “Pay now”, the transaction is always ready to be executed!

4. Hidden Maintenance Fees:

Have you ever tried paying for a simple $10 subscription fee, only to realize you were hit with a monthly card maintenance fee, an international transaction fee, and a currency conversion fee?

By the time the transaction is done, the $10 item now costs you $13-$15. How unnerving it can be!

With Cardtonic‘s one-time $1.5 card creation fee and $0 monthly maintenance fee, you can be sure your international shopping transactions remain transparent.

Also, the foreign exchange rates are always updated in real-time. So, you are always well aware of the actual cost of your transaction before proceeding.

5. Security Concerns (Fraud):

Digital payment fraud is one of the biggest issues faced by online shoppers today.

For context, according to Statista, digital payment fraud cost consumers over $40 billion globally in 2025 alone.

Using your primary bank card on every site you find on the net can significantly increase your security exposure and risk of compromise.

Cardtonic’s virtual card comes through by serving as a “firewall” for your finances. Since it’s a virtual card, it’s not linked to your main bank account. You only need to move the money you need to spend.

Also, other anti-money laundering (AML) measures have been put in place, including a know-your-customer (KYC) process, two-factor authentication (2FA), and an ability to instantly freeze your card upon noticing any suspicious activity.

With these, you can be rest assured of a safe and secure transaction session while shopping on your favourite platform.

Frequently Asked Questions About Cross-Border E-Commerce Payments

Why Is My Local Debit Card Being Rejected On International Websites?

Most local cards lack the international Bank Identification Number (BIN) clearance required by global merchants or have lower spending limits.

Cardtonic offers a virtual card that works across most global shopping platforms, with impressive spending limits.

Can I Use Cardtonic To Pay For Subscriptions Like Netflix, X, Or ChatGPT?

Absolutely! Cardtonic cards are perfect for recurring payments on Netflix, X, ChatGPT and many other subscription-based platforms. All you need to ensure is that your card is funded before the billing date to avoid service disruptions.

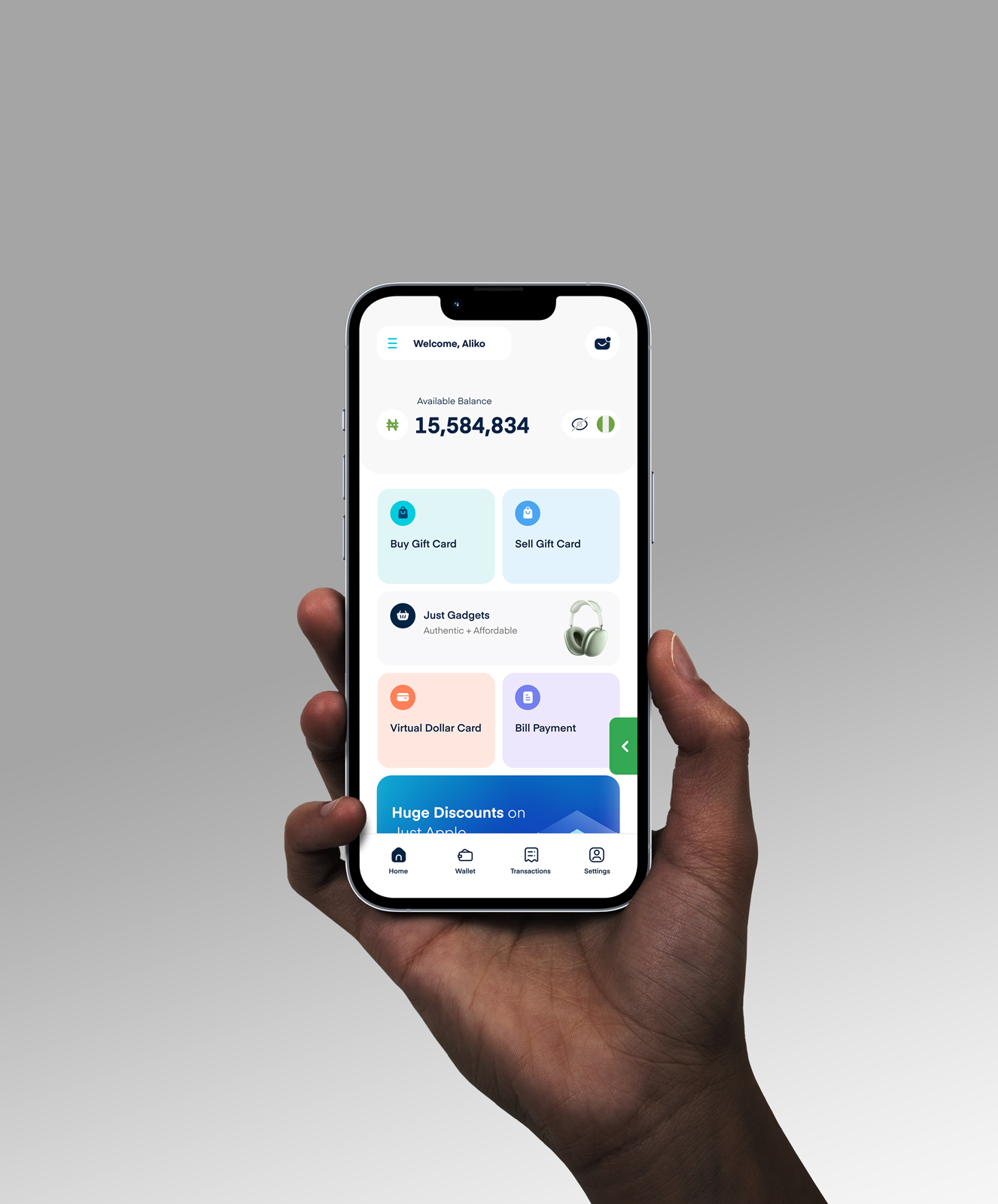

How Can I Get the Cardtonic Virtual Card?

Getting a cardtonic virtual card is absolutely seamless. First, download the app on Google playstore or Apple appstore and sign up to create your account. Complete the KYC (Know-your-customer) process. Then, fund your cardtonic wallet via any of the different funding options (bank transfer, card, USSD, gift cards).

Finally, select your preferred type of virtual card (Regular or Platinum and Visa or Mastercard). Your card details will be instantly sent to you.

How Do I Fund My Cardtonic Virtual Card?

You can do this in 3 easy steps. First, fund your Cardtonic Wallet via a bank transfer. Then, go to the “Virtual Card” section in the app. Finally, click “Top Up” using your wallet balance, and Voila! Your virtual card is now funded.

What Is The Most Common Method Of Payment When Shopping Online?

Digital wallets and debit/credit cards make up over 70% of all e-commerce payment methods globally. They are the most used because of their security and transaction execution speed.

Are There Any Monthly Maintenance Fees For The Virtual Card?

No! Cardtonic charges no monthly maintenance fee for its virtual card. You only pay a one-time $1.5 card creation fee to create your virtual card.

Conclusion

So, there we have it! The top 5 most common online shopping payment issues and how Cardtonic’s virtual card is well-positioned to ensure you have a smooth shopping experience.

Online shopping should be fun and not a hassle!

If you’re really ready to up your shopping game, head over to the Cardtonic app, register, get your virtual card funded, and begin the turn of a smooth and absolutely stress-free shopping experience!