Virtual Cards vs. Physical Cards: Which is More Secure?

These days, most people prefer to use their cards to pay for goods at stores. Thanks to the convenience that comes with doing so. Nobody loves to move around with bundles of cash anymore. However, using cards for payments comes with its downsides. Let me share a story with you.

Some time ago, I picked up my card to quickly grab some groceries at a nearby store. I didn’t pay much attention while making payments at the point-of-sale terminal. That’s how my card information was stolen, and my account was completely emptied.

Well, my experience is a testament to the fact that everyone needs a virtual card.

In this guide, we’ll be exploring the differences between virtual and physical cards to know which is more secure to use. But first things first, let’s get to know what physical and virtual cards are. Shall we?

What Are Physical Cards?

Physical payment cards, provided by banks and other financial institutions, are traditional cards issued in a tangible, physical format. They are mostly plastic with a chip and magnetic stripe. You can use your physical card at ATMs or point-of-sale terminals.

What Are Virtual Cards?

As the name suggests, virtual cards are digital payment cards that exist only in electronic form. However, they work just like traditional cards, offering a unique card number, expiration date, and security code for transactions.

With the rise of digital payments, virtual cards are becoming more popular due to their ease of use, security, and speed. Many people now prefer them over physical cards, signalling a shift toward a fully digital payment future.

8 Security Differences Between Virtual Cards and Physical Cards

The major security differences between virtual and physical cards are less physical risk, unique card numbers, expiration dates, two-factor authentication, real-time transaction monitoring, control over card deactivation, skimming and cloning protection, and one-time-use or merchant-specific numbers.

| Attributes | Physical Cards | Virtual Cards |

| Physical Risk | High | Less |

| Card Number | Only one card number | Single-use or merchant-specific numbers |

| Expiration Dates | Usually years, and non-customisable | Customisable expiration dates, even for single-use |

| Two-factor authentication (2FA) | Not available in most cases | Available |

| Real-time Transaction Monitoring | Not available | Available |

| Card Deactivation | Not readily accessible | Instant card’s deactivation feature |

| Skimming and Cloning | Prone to skimming and cloning risks | No traditional skimming and cloning risks |

| One-time Use or Merchant-specific Number | Not available | One-time use or merchant-specific numbers feature is present |

1. Less Physical Risk:

Chances are, either you or someone you know has lost a physical card before. If it falls into the wrong hands, the account can be drained quickly.

With virtual cards, there is no risk of losing your card since it only exists digitally on your phone. This is one of virtual cards’ biggest yet often overlooked security advantages.

2. Unique Card Numbers:

We can’t discuss a virtual vs. physical card security comparison without mentioning the unique card numbers feature.

With your virtual card, you can generate unique card numbers for each transaction or specific merchants. That way, your primary account is safe even if a particular card number is compromised. No doubt, it’s a great virtual card fraud prevention feature.

Physical cards only have one card number printed on them, which remains consistent until the card’s expiration date. If the number is compromised, like I experienced at the grocery store, your account is no longer safe.

3. Expiration Dates:

You see, physical cards take time to expire. They usually have expiration dates years in the future. This greatly undermines physical card safety. In a situation where the card details are compromised, the scammer has a long time frame to carry out fraudulent activities.

In the case of virtual cards, the expiration dates are customisable. You can set very specific expiration dates, even for single use. This reduces the time frame for fraudulent use if the card details were stolen.

For instance, if a fraudster succeeds in stealing the details of a virtual card that was only created for a single transaction use, it will be of no benefit to him.

4. Two-Factor Authentication (2FA):

Another thing that makes virtual cards more secure than physical debit cards is the two-factor authentication feature.

Most virtual cards require two forms of identification before completing a transaction. This means, even if you have access to the card’s information, including the password, you’ll need another means of verification like a security code, fingerprint, or facial recognition to use the card.

A physical card does not usually have 2FA authentication to protect you from fraud. It only has basic security measures like PIN, which is less effective than two-factor authentication.

5. Real-time Transaction Monitoring:

Virtual card providers enable you to monitor every transaction on your card in real-time. This makes it easy for you to know exactly where your funds are going.

Unfortunately, you can’t track your transactions on a physical card the same way, so you’ll be in the dark about any suspicious activity.

6. Control over Card Deactivation:

Did you suspect any fraudulent activity on your virtual card? If yes, don’t fret. With a few clicks, you can either freeze or deactivate the card yourself on the card’s provider platform, preventing further unauthorised debits.

Physical cards, however, don’t offer the same flexibility. Most times, you’ll have to contact customer service, and by the time they respond to block the card, your bank account might already be empty.

7. Skimming and Cloning Protection:

Malicious individuals attach skimming devices to ATMs, gas pumps, or point-of-sale terminals to capture your physical card data. Then, they proceed to create a duplicate of your card with a cloning device using the stolen data. This enables the fraudster to make illegal transactions with the duplicated card.

Because virtual cards are entirely digital, they cannot be skimmed in the traditional sense—that means enhanced security.

8. One-time Use or Merchant-specific Numbers Feature:

Virtual debit cards can be designed for one-time use or restricted to a specific merchant. If you use a one-time-use virtual card and its details get compromised afterwards, there’s no need to worry—the card becomes useless, preventing fraudsters from accessing your funds.

Similarly, merchant-specific virtual cards can only be used with the assigned merchant. Even if someone steals your card details, they won’t work anywhere else.

Physical debit cards, on the other hand, don’t have this security feature. The same card number is used for all transactions throughout the card’s lifespan. This means that if your physical card details fall into the wrong hands, your funds could be at serious risk.

Frequently Asked Questions About Virtual Cards vs. Physical Cards

1. Is a Virtual Credit Card the Same as a Physical Credit Card?

No, a virtual credit card is not the same as a physical credit card, even though they share some similarities. A virtual credit card exists only in digital format, while a physical credit card is a plastic card with a chip and magnetic stripe.

2. Is a Physical Card Used in the Same Way as a Virtual One?

No, a physical card is not used the same way as a virtual card. However, both can be used to make payments. You can use your physical card either in-store, online, or at ATMs. While virtual cards can only be used online.

3. Are Virtual Credit Cards More Secure Than Physical Ones When It Comes to Online Purchases?

Yes, virtual credit cards are more secure than physical credit cards for online purchases. Unlike physical credit cards, virtual credit cards often generate a one-time-use or merchant-specific number, minimising the possibility of fraud.

4. Is a Virtual Card Better Than a Physical Debit Card?

Yes, virtual debit cards are better than physical debit cards, primarily because of online payment safety. It’s more secure to use virtual cards for online payments than physical debit cards. Other advantages of virtual debit cards include convenience, customisable spending limits, and real-time transaction monitoring.

5. How Do I Choose Between a Virtual Debit Card and a Physical Debit Card?

If most of your transactions are online and you value instant access, top-notch security, and convenience, then a virtual debit card is your best bet. But if your transactions are mostly in-person and you need access to cash, then a physical debit card is what you need.

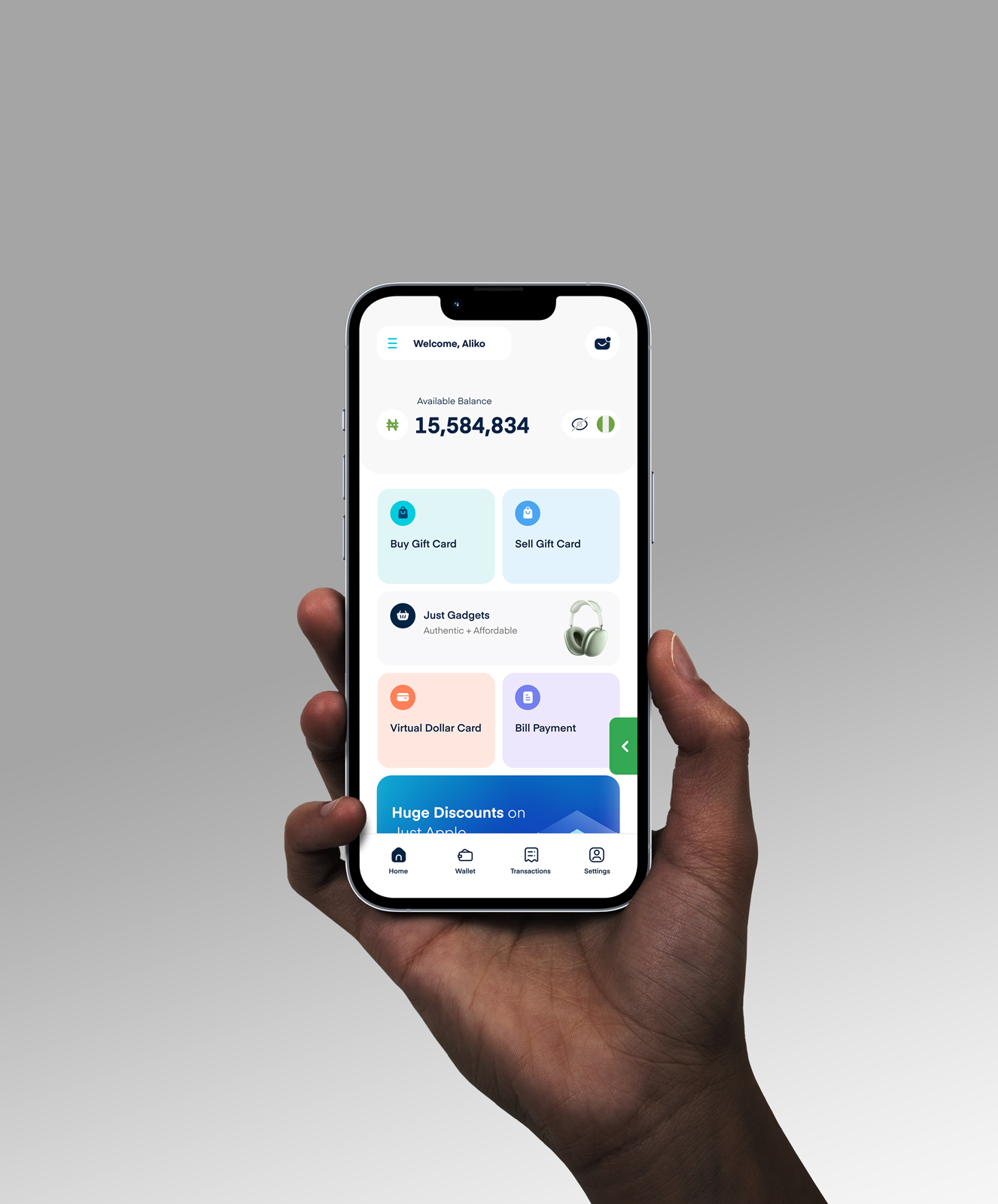

6. Where Can I Get a Virtual Card in Nigeria Today?

You can get a virtual card in Nigeria today on Cardtonic. The process is simple and stress-free. Just download the Cardtonic app, sign up for an account, finish the basic KYC steps, and you’re all set. Fortunately, it’s also cheap to own a Cardtonic virtual card.

7. What is the Disadvantage of a Virtual Debit Card?

The main disadvantage of a virtual debit card is that it can only be used for online transactions. You also can’t use a virtual debit card to withdraw cash from an ATM.

Conclusion

Making payments shouldn’t just be convenient; it should also be secure. That’s where virtual cards step in to provide a secure solution.

Always remember that virtual card security benefits include less physical risk, unique card numbers, expiration dates, two-factor authentication, real-time transaction monitoring, control over card deactivation, skimming and cloning protection, and one-time-use or merchant-specific numbers. These make virtual cards more secure than physical ones.

Thankfully, with numerous top virtual card providers like Cardtonic, a virtual card is just a few clicks away. Grab yours now to experience seamless and safe transactions anytime, anywhere.