Virtual Dollar Cards vs. Traditional Debit Cards: Which Offers Better Perks?

One thing I like about being born in this era is the availability of options. We have options for everything, including how we pay for items. How we manage and spend our money has changed significantly over the years. Now, we have virtual dollar cards that we can’t see or touch but still get the job done, and we also have numerous traditional debit cards.

While both cards offer a means to manage your money, they each have unique perks and disadvantages. So, the big question is which one suits your needs best? In this article, we will compare Virtual Dollar Cards to traditional Debit cards to see which offers better perks.

Understanding Virtual Dollar Cards And It’s Benefits

A virtual dollar card is a digital card that operates like a prepaid debit card but with one significant distinction—it exists solely online. You can’t see or touch them physically.

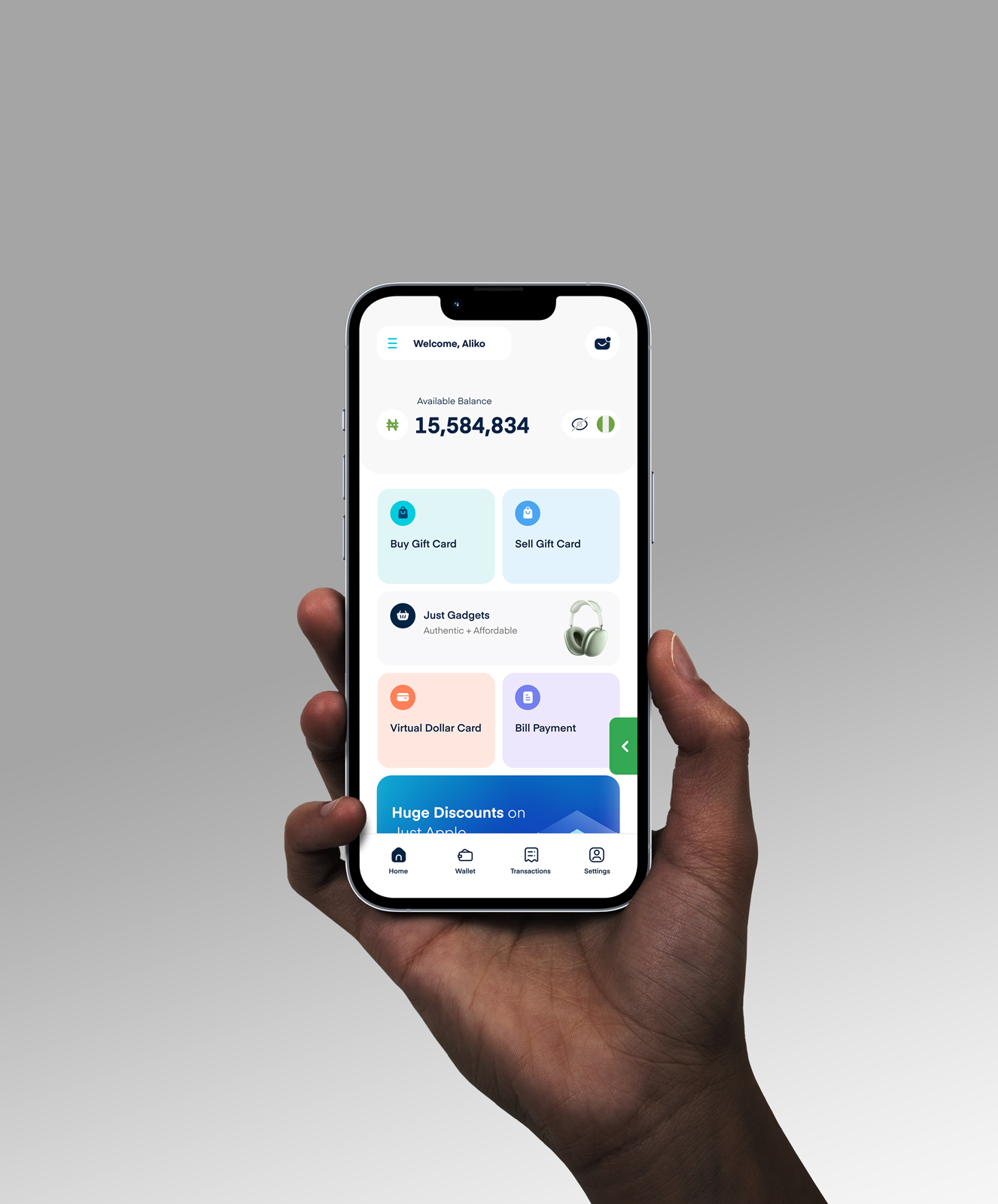

These cards are issued by fintech companies like Cardtonic and are stored on the app.

Key Perks of Virtual Dollar Cards

1. Instant Creation and Use: Indomie, fried eggs, and virtual dollar cards have something in common: quick satisfaction. Virtual dollar cards can be created instantly, allowing for immediate international transactions so you can get to shopping immediately.

2. No Risk of Physical Theft: Since virtual dollar cards exist only in the digital world, they eliminate the risk of physical loss or theft. Aside from being relatively safer, it is also a good option for clumsy people. My older sister, for example, has misplaced her traditional debit card three times this year alone. I know her bank hates to see her coming.

3. International Acceptance: As the name suggests, virtual dollar cards are often denominated in US dollars and can be used globally for international purchases. So, if you want to pay for a Udemy or Coursera course, shop online at your favourite brand, or renew your Apple Music or Spotify subscription, the virtual dollar card helps you achieve this.

The Traditional Debit Card And It’s Perks

A traditional debit card is a physical card issued by your bank that allows you to make transactions or cash withdrawals by deducting money from your account. It is linked to your bank account.

Key Perks of a Traditional Debit Card:

1. Ease of Use: Debit cards are widely accepted at marketplaces, POS centres, stores, online, and ATMs globally.

2. Instant Creation: Nowadays, most banks offer an instant debit card service. You can pick up your ATM card at the bank.

3. Fast Transactions: Purchases and withdrawals are typically processed immediately, so you can track your balance in real-time.

Now that you understand both cards and their perks, let’s compare them directly.

Traditional Debit Cards vs. Virtual Dollar Cards

To properly compare both, we will examine their nationwide and global acceptance, security and privacy, ease of issuance, and fees and charges.

1. Nationwide Use:

Traditional debit cards used in their home country are generally accepted everywhere. You can use them at ATMs, supermarkets, stores, restaurants, local markets, POS centres, etc. Virtual dollar cards, on the other hand, are not as popular for physical payments. Imagine telling a POS lady you want to withdraw 20,000 Naira, and then you start calling out your virtual dollar card details; they might chase you away with water.

2. Global Acceptance:

Virtual Dollar Cards are designed primarily for international transactions. Whether online shopping, renewing your international subscriptions, or making payments on global platforms, virtual dollar cards shine because they are usually denominated in Dollars and accepted worldwide without worrying about currency conversion rates or restrictions. However, most traditional debit cards are tied to your local currency. Even though you can use them internationally, you often face certain restrictions or limitations.

3. Security and Privacy:

Virtual Dollar Cards add an extra layer of security because they are not linked directly to your main bank account. If you suspect fraudulent activity, you can quickly deactivate or block the card without compromising your main financial account. Virtual Dollar Cards allow you to make secure online payments. Traditional debit cards, on the other hand, are directly tied to your bank account. If you lose your card, you must call your bank to block it immediately to avoid the risk of losing all your money.

4. Ease of Issuance:

Most Virtual Dollar cards are easy to create, depending on the platform issuing them. For example, on Cardtonic, you can create your virtual card within a few minutes as long as you have completed your KYC process on the app. It is also relatively easy and quick to get a debit card from your bank because most banks offer an instant card service nowadays.

5. Fees and Charges:

Most Virtual Dollar Card transactions incur a charge of about $2 – $5, depending on the provider. With traditional debit cards, you are charged about 2,000 Naira for creation and receive a 50-150 Naira charge when you withdraw money from an ATM that is not from your bank.

Frequently Asked Questions About Traditional Debit Cards and Virtual Dollar Cards

1. Is a Virtual Card Better Than a Debit Card?

Neither the virtual nor debit card is better than the other because they both have unique functions. If you are looking for a more online-based payment method, then you should opt for the virtual card.

2. What is The Disadvantage of a Virtual Dollar Card?

A major disadvantage of the virtual dollar card is its popularity within Nigeria. It is not a payment method generally acceptable in the country, such as marketplaces, POS centres, ATMs, etc.

3. What Are The Benefits of Having a Virtual Dollar Card?

The virtual dollar card has many benefits for individuals and businesses. Such as renewing subscriptions, paying for online courses, shopping online, using it as a means of payment when travelling internationally, and more.

4. Which Virtual Dollar Card is Best in Nigeria?

The best virtual dollar card in Nigeria currently is Cardtonic. You receive your card almost instantly. They have very low fees and zero to no restrictions.

5. How Can I Get a Virtual Dollar Card on Cardtonic?

It’s simple! To get a virtual Dollar card on Cardtonic, you need to become a Cardtonic user and complete your KYC.

Conclusion

In conclusion, the answer largely depends on you when choosing between a virtual dollar card and a traditional credit card. I know the decision may be difficult, so I have simplified it by looking at key factors such as their nationwide and global acceptance, security and privacy, ease of issuance, and fees.

A virtual dollar card would be ideal if you shop online frequently, have recurring subscriptions, travel, value-enhanced security, or take courses online. However, if you are looking for a popular means of payment in Nigeria that is quick and easy to obtain, then a traditional debit card should be your go-to option.