Prepaid Cards With ATM Convenience: 6 Options to Consider

If you’ve ever tried using PayPal in Nigeria, you’ve probably heard people say it doesn’t work here. Out of curiosity, I decided to check for myself.

To my surprise, PayPal actually works in Nigeria. And not just that, they also offer a prepaid card that functions like a debit card. You can use it to shop, pay bills, and even make withdrawals from ATMs.

That sounded perfect to me. Imagine getting paid from freelance gigs, and instead of transferring the money to your bank account, you just use your PayPal card to spend directly.

But after reading a bit more, I realised the card isn’t available in Nigeria.

That discovery got me thinking. If PayPal has something like this, what other prepaid cards are out there? Which ones support ATM withdrawals? And more importantly, are there any that Nigerians can actually use?

So I did some digging. In this article, I break down the international options and a few that work right here in Nigeria.

What Are the 6 Prepaid Cards With ATM Access?

The six prepaid cards with ATM access include PayPal Prepaid Mastercard, Netspend Visa, Greenlight Prepaid Mastercard, Walmart MoneyCard, Brinks Prepaid Mastercard, and Bluebird American Express.

1. PayPal Prepaid Mastercard

This was the first prepaid card I came across while researching if PayPal actually works in Nigeria and at first, it got my hopes up.

The PayPal Prepaid Mastercard works like a debit card. It connects directly to your PayPal balance, so once you get paid, you can move money to the card and use it to shop online, pay bills, swipe in stores, or withdraw cash from ATMs that support Mastercard.

You can also fund it through direct deposit or bank transfer, which makes it even more useful for freelancers and remote workers who get paid from multiple sources.

The only catch is that it’s only available to users in the U.S.

If you’re new to PayPal or wondering how to open an account, read this simple guide on how to open a PayPal account.

2. Netspend Visa Prepaid Card

While looking into reliable prepaid cards, the Netspend Visa stood out for its flexibility and ease of use. It works just like a debit card, letting you shop online, pay bills, and withdraw from ATMs that support Visa.

You can fund it through direct deposit, bank transfers, or at partner cash reload locations. It also comes with a mobile app that helps you track spending and set alerts, which is helpful if you’re trying to manage your money better.

The only downside is that it’s only available in the U.S.

3. Greenlight Prepaid Mastercard

Greenlight is more than just a prepaid card with ATM access. It’s designed to help parents teach their kids how to manage money responsibly. During my research, it stood out as one of the top tools for financial education at home.

With the Greenlight app, parents can set spending limits, approve or block transactions, and receive real-time alerts. You can even turn ATM access on or off, depending on what your child needs.

The card supports regular payments, online shopping, and ATM withdrawals. Reloading is simple through a linked debit card or bank transfer.

Although it’s only available in the U.S., it would be a powerful tool for Nigerian parents if it ever becomes accessible here.

4. Walmart MoneyCard

If I had a naira for every time someone wished Walmart was in Nigeria, I’d probably be able to fund my own Walmart branch.

During my research on prepaid cards with ATM access, the Walmart MoneyCard stood out. It’s built for people who shop at Walmart often, offering cashback rewards on purchases and free ATM withdrawals at Walmart MoneyCenters.

It functions just like a debit card; you can use it to pay bills, shop online, and withdraw cash. You can also reload it easily at any Walmart store or through direct deposit and mobile check deposit.

The only problem? There’s no Walmart in Nigeria, and this card isn’t available here either.

If it were, it would definitely be one of the best prepaid cards with ATM access for everyday spending. But for now, it’s one of those things that Nigerians can only admire from afar.

5. Brinks Prepaid Mastercard

When I first saw the name, I thought of security trucks and safes, and honestly, that theme checks out.

The Brinks Prepaid Mastercard focuses heavily on security. It offers real-time transaction alerts, card-blocking features from the mobile app, and account protection that makes it feel a bit more serious than the average prepaid card with ATM access.

You can use it to pay bills, shop online, and withdraw cash from ATMs. It also supports direct deposits, bank transfers, and mobile check deposits for reloading.

It’s designed for people who want full control over their money without risking access or overspending.

Unfortunately, like most of the others, this card is only available in the U.S.

6. Bluebird American Express Prepaid Account

This one came up a lot during my research, and honestly, it’s one of the most feature-packed prepaid cards with ATM access I found.

The Bluebird card, backed by American Express, allows you to shop, pay bills, and withdraw cash from MoneyPass ATMs without extra fees. But what really stood out to me is the ability to create sub-accounts. You can set spending limits for kids or roommates, which is perfect for families or shared expenses.

You can reload the card through direct deposit, mobile check deposit, or at Walmart stores. It also comes with an easy-to-use mobile app for managing your money on the go.

As expected, it’s only available in the U.S. But if you live there and want a prepaid card that helps you budget smarter and spend safely, this one checks all the boxes.

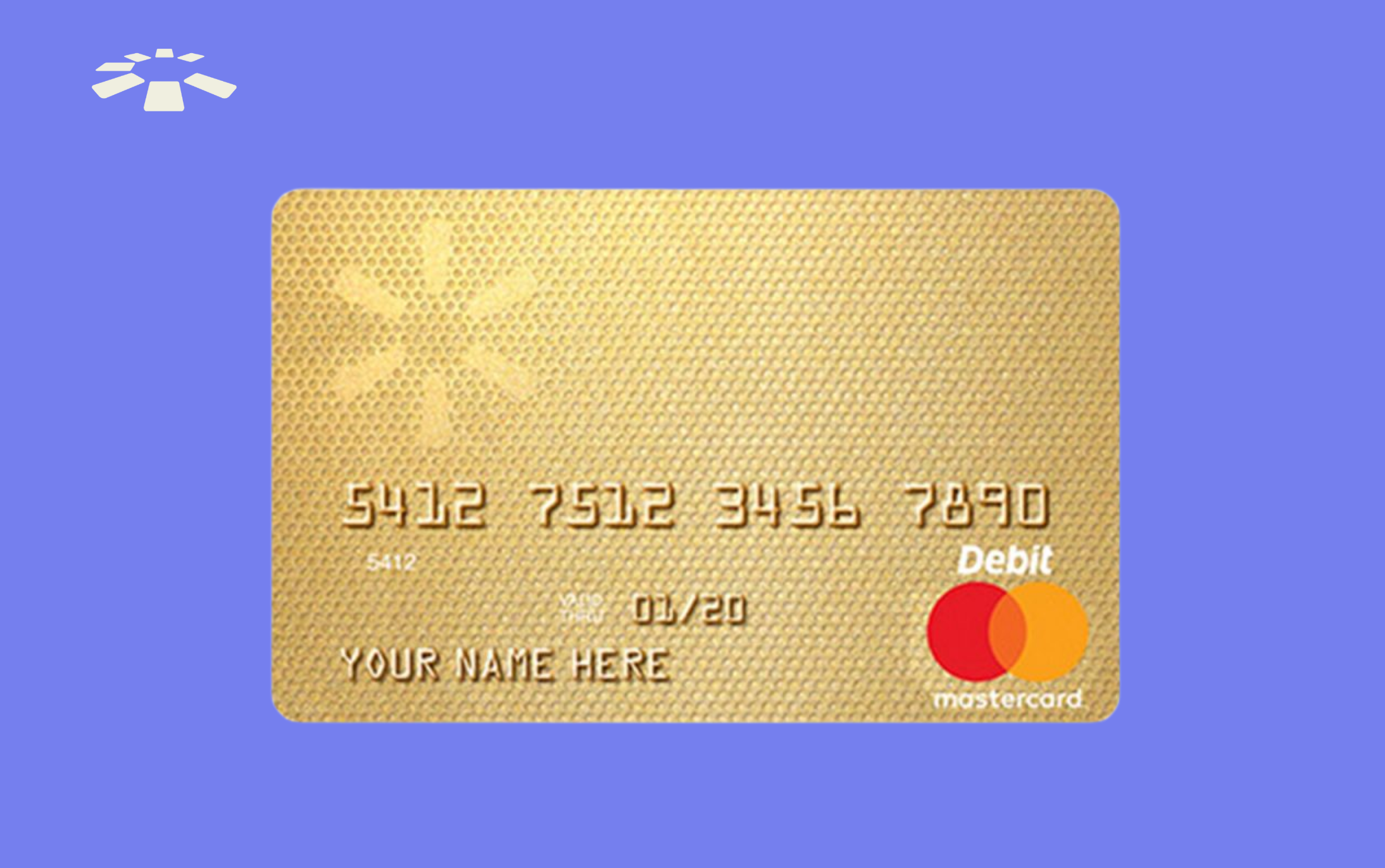

Are There Prepaid Cards With ATM Access in Nigeria?

Yes, there are. While most international prepaid cards aren’t accessible to Nigerians, a few trusted banks in the country offer Naira-based prepaid cards that allow you to make withdrawals from ATMs, pay at POS terminals, and shop online locally.

Based on my research, some of the most reliable options include the Access Bank Verve Prepaid Card, which supports ATM withdrawals across Nigeria and works for local online payments.

FirstBank’s Naira Visa Prepaid Card is another strong option. It’s reloadable, widely accepted, and designed for both physical and digital transactions within the country.

Then there’s Stanbic IBTC’s Naira Prepaid Card, which offers mobile banking access, spending control, and a simple application process.

All of these cards are issued by well-established Nigerian banks and can be picked up at any nearby branch.

Factors to Consider When Choosing a Prepaid Card With ATM Access

When choosing a prepaid card with ATM convenience, consider worldwide acceptance, fees, reload options, and security features.

1. Worldwide Acceptance

One of the first things I looked at during my research was whether a card could be used easily both online and offline.

Some prepaid cards only work within one country or are limited to certain websites. Others, like Visa and Mastercard prepaid cards, are accepted at most ATMs, POS terminals, and e-commerce platforms.

If you’re shopping, paying bills, or withdrawing cash often, broad acceptance is key. It’s frustrating to load a card and find out you can’t use it where you need it most.

2. Fees

This is where many people get caught off guard. During my comparison, I found that some cards charge maintenance fees monthly, deduct a percentage on ATM withdrawals, or even apply penalties if the card remains unused for a while.

A card may look cheap on the surface, but hidden fees can quietly drain your balance. Always read the terms or look up verified user experiences to be sure of what you’re signing up for.

3. Reload Convenience

A prepaid card is only as useful as its funding options. Some cards support direct deposits, mobile banking transfers, and in-person cash reloads, while others are limited to just one or two methods.

For freelancers or people who earn from multiple sources, flexibility here is non-negotiable. The easier it is to load your card, the more useful it becomes in real-world situations.

4. Security Measures

I paid special attention to this because prepaid cards aren’t linked to a traditional bank account, so you need built-in protection. The best cards come with real-time spending alerts, mobile app access, PIN protection, and the ability to freeze your card if something feels off.

It’s not just about peace of mind, it’s about safeguarding your money against unauthorised use.

Frequently Asked Questions About Prepaid Cards With ATM Access

1. Can You Use an ATM With a Prepaid Card?

Yes, you can. Most prepaid cards, especially those from trusted providers like Visa or Mastercard, allow you to withdraw cash from ATMs just like a regular debit card. However, the ATM must support the same card network (e.g., Visa or Mastercard).

2. Can I Convert My Gift Card Into a Prepaid Card?

Not directly. Most gift cards can’t be turned into prepaid debit cards. However, you can sell your unused gift cards for cash on platforms like Cardtonic, then use the money to fund a Naira prepaid card.

3. Are There Prepaid Cards With No ATM Fees?

Yes, some prepaid cards come with little to no ATM fees, but it depends on the provider and where you withdraw from. For example, cards like the Bluebird American Express offer free withdrawals at specific ATM networks like MoneyPass in the U.S. Others may waive fees if you use their partner ATMs.

4. Which Type of Card Is a Prepaid Card?

A prepaid card is a payment card that you load with money in advance before using it. Unlike a debit card that pulls funds from a bank account or a credit card that borrows money from a credit line, a prepaid card only allows you to spend what you’ve already loaded onto it.

5. How Do I Know If My Card Is Prepaid?

You can usually tell your card is prepaid by checking how it’s funded and what’s printed on it. A prepaid card requires you to load money onto it before use, and it’s not linked to a traditional bank account.

Conclusion

Prepaid cards with ATM access are a great way to manage your spending, especially if you want more control and flexibility.

While most international options like PayPal and Netspend are only available in the U.S., Nigerian banks such as Access Bank, FirstBank, and Stanbic IBTC offer reliable Naira-based prepaid cards. They work for local ATM withdrawals, online payments, and POS transactions.

Just choose the one that fits your lifestyle, check the fees, and make sure it’s easy to reload and use.